Regarding managing your Social Security benefits, opting for direct deposit can offer a range of benefits. By authorizing the government to send your benefit payments electronically to a designated bank account, you can ensure that your funds are secure and easily accessible. This process eliminates the need for physical checks, reducing the risk of theft or loss, and guarantees that the money will be available in your account on the scheduled day.

Let’s delve deeper into the key elements of the Social Security direct deposit form and explore how you can set it up seamlessly.

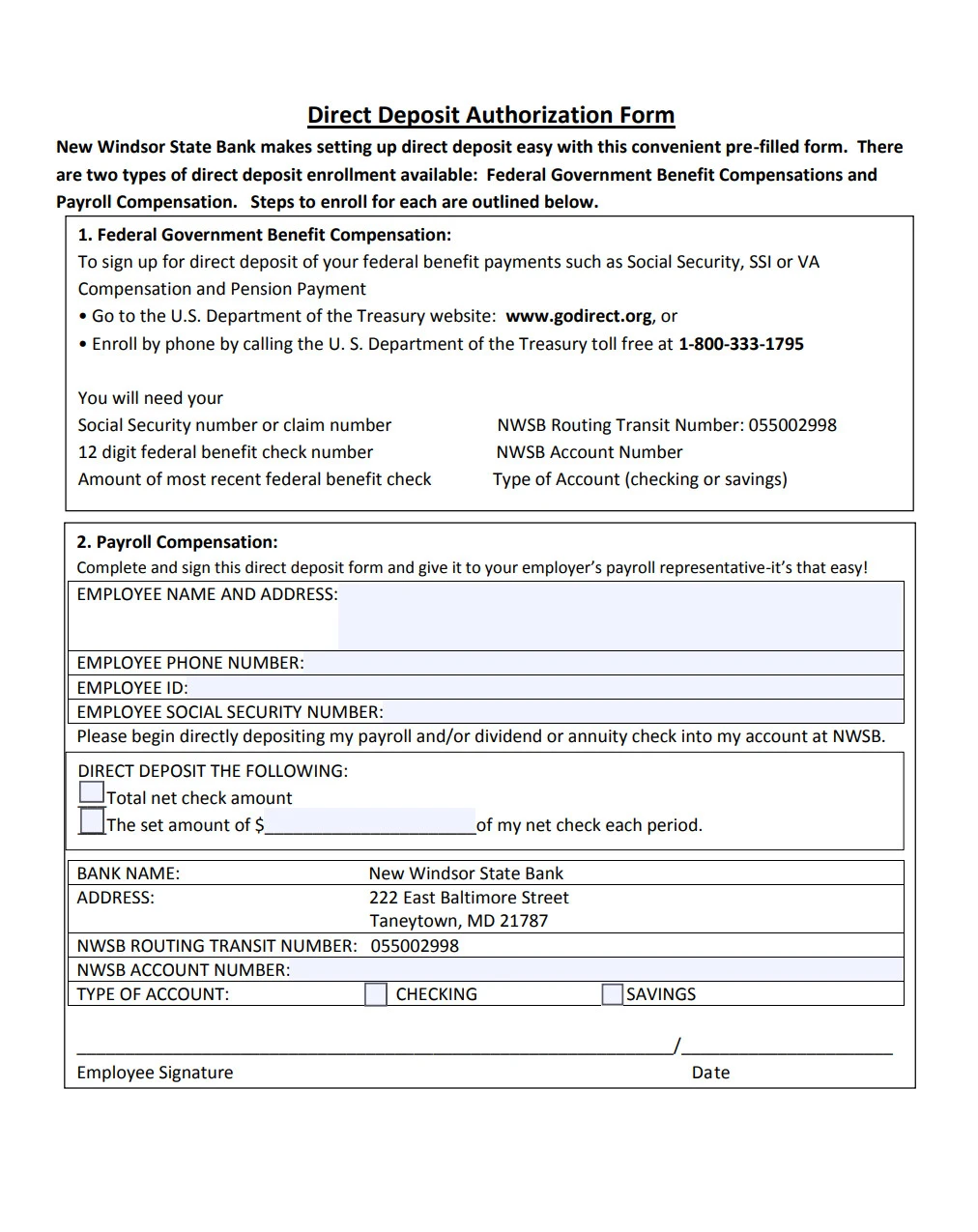

What is a Social Security Direct Deposit Form?

A Social Security Direct Deposit Form is a document that allows individuals to authorize the government to electronically deposit their Social Security benefit payments into a designated bank account.

By completing this form, beneficiaries can ensure that their funds are received securely and promptly, eliminating the need for physical checks.

Why Should You Use Direct Deposit for Your Social Security Benefits?

There are several compelling reasons to consider using direct deposit for receiving your Social Security benefits:

Enhanced Security

With direct deposit, there is no risk of lost or stolen checks, as the funds are transferred electronically to your bank account. This provides added security and peace of mind knowing that your benefits are safe and accessible.

Convenience and Accessibility

Direct deposit offers unparalleled convenience by ensuring that your funds are automatically deposited into your account on the scheduled payment date. This eliminates the need to visit a bank or wait for a check to arrive in the mail.

Reliability and Timeliness

By opting for direct deposit, you can count on the timely receipt of your Social Security benefits without worrying about delays or disruptions that can occur with paper checks. The funds are available in your account on the designated day, allowing you to manage your finances effectively.

Cost Savings

Direct deposit is a cost-effective option for receiving your benefits, as there are no fees associated with paper checks or manual processing. This can lead to savings in terms of time and resources, making it a practical choice for many beneficiaries.

Key Elements of the Social Security Direct Deposit Form

When completing the Social Security Direct Deposit Form, it is essential to pay attention to the following key elements:

Bank Account Information

One of the critical components of the form is providing accurate bank account details, including the routing number and account number. This information is crucial for ensuring that your benefits are deposited into the correct account securely.

Social Security Number

Your Social Security Number is another essential piece of information required on the form to verify your identity and link your benefits to the correct account. Ensuring the accuracy of this number is vital for the successful processing of your direct deposit request.

Contact Information

Providing up-to-date contact information, such as your mailing address and phone number, is necessary for communication and verification purposes. This information helps the Social Security Administration confirm your identity and reach out to you if needed.

Verification Process

Once you have completed the form and submitted it to the Social Security Administration, they will verify the information provided before processing your direct deposit request. This verification process helps ensure that your benefits are sent to the correct account securely and without any errors.

How to Set Up Social Security Direct Deposit

Setting up direct deposit for your Social Security benefits is a straightforward process that can be completed in a few simple steps:

Obtain the Form

The first step is to obtain the Social Security Direct Deposit Form, which can be downloaded from the official Social Security website or requested from your local Social Security office. You can also opt to fill out the form online through the Social Security Administration’s secure portal.

Provide Required Information

Fill out the form with all the necessary information, including your bank account details, Social Security Number, and contact information. Double-check the accuracy of the information provided to avoid any delays in processing your direct deposit request.

Submit the Form

Once the form is completed, submit it to the Social Security Administration through the designated channels, which may include online submission, mailing the form, or delivering it in person to your local office. Ensure that all required fields are filled out correctly before submission.

Confirmation and Processing

After submitting the direct deposit form, you will receive confirmation from the Social Security Administration once your request has been processed successfully. This confirmation typically includes details such as the effective date of the direct deposit and any additional instructions or notifications.

Verification of Information

It is essential to verify that the information provided on the form matches your bank account details and Social Security Number accurately. Any discrepancies or errors in the information may lead to delays in processing your direct deposit request, so it is crucial to review the form carefully before submission.

Tips for Using Social Security Direct Deposit

To make the most of your Social Security direct deposit, consider the following tips for a seamless and secure experience:

Keep Your Information Updated

Regularly review and update your bank account information and contact details with the Social Security Administration to ensure that your benefits are deposited correctly and securely. Any changes to your account should be promptly reported to avoid disruptions in receiving your payments.

Monitor Your Account

Stay vigilant by checking your bank account regularly to verify that your Social Security benefits are being deposited as expected. Monitoring your account allows you to detect any discrepancies or unauthorized transactions promptly and take appropriate action if needed.

Protect Your Information

Safeguard your Social Security Number, bank account details, and any other sensitive information related to your benefits to prevent identity theft or fraud. Avoid sharing this information with unauthorized individuals or websites to maintain the security of your funds and personal data.

Set Up Alerts

Consider setting up alerts or notifications with your bank to receive updates on incoming deposits and account activity. This can help you stay informed about the status of your Social Security direct deposit and quickly address any issues or concerns that may arise.

Review Statements and Documentation

Review your bank statements, benefit statements, and any related documentation regularly to ensure that your Social Security benefits are being deposited correctly and in the expected amounts. Promptly report any discrepancies or irregularities to the Social Security Administration for resolution.

Seek Assistance if Needed

If you encounter any difficulties or have questions about your Social Security direct deposit, do not hesitate to reach out to the Social Security Administration or your banking institution for assistance. They can provide guidance on setting up, managing, or troubleshooting your direct deposit arrangement.

Plan Ahead

Plan for any changes in your banking or personal information that may affect your direct deposit arrangement. Notify the Social Security Administration in advance of any updates to ensure a smooth transition and avoid disruptions in receiving your benefits.

Stay Informed

Stay informed about any updates or changes to the Social Security direct deposit process, regulations, or policies that may impact your benefits. Regularly check the Social Security Administration’s website or contact them directly to stay up to date on important information related to your payments.

Keep Records

Keep detailed records of your direct deposit setup, including confirmation emails, receipts, and any correspondence with the Social Security Administration. Having a paper trail of your interactions can help resolve any issues or disputes that may arise in the future.

Utilize Online Tools

Take advantage of online tools and resources provided by the Social Security Administration to manage your direct deposit preferences, update your information, and access important documents related to your benefits. These digital platforms can streamline the process and offer added convenience for beneficiaries.

Social Security Direct Deposit Form

In conclusion, a Social Security Direct Deposit Form is a convenient way to ensure your benefits are safely and automatically deposited into your bank account. It helps you save time, avoid delays, and manage your funds securely.

Simplify your payments—download our Social Security Direct Deposit Form and set up your direct deposit with ease today!

Social Security Direct Deposit Form – DOWNLOAD