In the world of business and finance, investment contracts play a crucial role in facilitating secure and transparent investment transactions. An investment contract serves as a legally binding framework that clearly defines the terms and conditions for an investment, protecting the interests and rights of both the investor and the company.

By establishing clarity on various aspects such as the investment amount, future returns, ownership stakes, control rights, and exit strategies, an investment contract fosters trust, minimizes potential disputes, and ensures legal compliance for both parties involved in the transaction.

What is an Investment Contract?

An investment contract is a formal agreement between an investor and a company seeking funding that outlines the terms and conditions of the investment arrangement. It serves as a roadmap for the investment relationship, providing a clear and structured framework for both parties to follow. Investment contracts can come in various forms, depending on the type of investment transaction and the specific terms agreed upon by the parties involved.

These contracts are essential for establishing a legally binding agreement that outlines the rights and obligations of each party, ensuring that the investment process is conducted in a transparent and compliant manner.

The Importance of an Investment Contract

Investment contracts play a crucial role in providing a solid legal foundation for investment transactions, offering protection and clarity to both investors and companies. Here are some key reasons why investment contracts are essential:

Ensuring Legal Compliance

One of the primary reasons why investment contracts are crucial is to ensure legal compliance with relevant laws and regulations governing investment transactions. By documenting the terms and conditions of the investment in a formal contract, both investors and companies can avoid potential legal pitfalls and disputes that may arise due to misunderstandings or ambiguities in the agreement. Investment contracts help ensure that the investment process is conducted in a transparent, fair, and compliant manner, protecting the interests and rights of all parties involved.

Protecting Rights and Interests

Another key benefit of investment contracts is that they provide a structured framework for protecting the rights and interests of both investors and companies. By clearly defining the terms of the investment agreement, including ownership stakes, control rights, and exit strategies, an investment contract helps prevent disputes and conflicts that may arise during the investment process. Investment contracts serve as a safeguard for all parties involved, ensuring that their rights are respected and their interests are protected throughout the duration of the investment.

Facilitating Transparent Communication

Investment contracts also play a vital role in facilitating transparent communication between investors and companies. By outlining the terms and conditions of the investment in writing, an investment contract ensures that both parties have a clear understanding of their rights, obligations, and expectations. This clarity helps build trust and confidence in the investment relationship, fostering open and honest communication between investors and companies. Transparent communication is essential for maintaining a strong partnership and resolving any issues or conflicts that may arise during the investment process.

Minimizing Disputes and Risks

One of the key advantages of using an investment contract is that it helps minimize disputes and risks associated with investment transactions. By clearly defining the terms of the investment agreement, including payment terms, ownership stakes, and exit strategies, an investment contract reduces the likelihood of misunderstandings or disagreements between investors and companies. This proactive approach to risk management helps mitigate potential conflicts, disputes, and legal issues that may arise during the investment process, ensuring a smooth and successful transaction for all parties involved.

Types of Investors

Investors can come in various forms, each with different preferences, risk appetites, and investment goals. Understanding the types of investors can help companies tailor their investment contracts to meet the specific needs and expectations of their potential funders. Here are some common types of investors:

Angel Investors

Angel investors are individual investors who provide funding to startups and early-stage companies in exchange for equity ownership. These investors are typically high-net-worth individuals who are willing to take on higher risks in exchange for the potential for significant returns. Angel investors often play a crucial role in supporting the growth and development of innovative startups, providing not only financial capital but also valuable expertise, connections, and mentorship to help entrepreneurs succeed.

Venture Capitalists

Venture capitalists are professional investment firms that provide capital to high-growth startups and emerging companies in exchange for equity stakes. These investors typically invest larger amounts of capital in startups with high growth potential, aiming to achieve substantial returns on their investments. Venture capitalists often take an active role in the companies they invest in, providing strategic guidance, networking opportunities, and support to help the business scale and succeed. Venture capitalists play a vital role in fueling innovation and driving economic growth by backing promising startups and helping them commercialize their ideas.

Private Equity Investors

Private equity investors are institutional investors that invest in established companies to achieve high returns through various strategies, such as buyouts or growth financing. These investors typically acquire a significant ownership stake in companies and work closely with management to improve performance, drive growth, and maximize value. Private equity investors often take a long-term view of their investments, seeking to create value through operational improvements, strategic initiatives, and financial engineering. Private equity investors play a critical role in providing capital to companies looking to expand, restructure, or achieve specific business objectives.

Crowdfunding Investors

Crowdfunding investors are individuals or groups of investors who pool their resources online to fund projects or ventures in exchange for rewards, equity, or debt. Crowdfunding has become an increasingly popular way for entrepreneurs and small businesses to raise capital from a large number of investors without relying on traditional sources of funding. Crowdfunding investors can contribute small amounts of capital to support projects they believe in, thereby gaining a stake in the venture’s success. Crowdfunding investors offer a democratized approach to investing, enabling individuals to participate in investment opportunities that were previously accessible only to institutional investors.

How to Negotiate Terms with Investors

Negotiating terms with investors is a critical step in the investment process, as it determines the conditions under which the investment will be made and the rights and obligations of each party. Here are some key tips for negotiating terms with investors effectively:

Understand Your Investors

Before entering into negotiations with investors, it is essential to research and understand their preferences, motivations, and expectations. Different investors may have varying risk tolerances, investment criteria, and objectives, so tailoring your pitch and investment terms to align with their interests is crucial. By conducting thorough due diligence on potential investors, you can better position your company and investment opportunity to attract the right investors who are likely to be a good fit for your business.

Be Transparent

Transparency is key when negotiating terms with investors. Provide clear and accurate information about your company, business model, financials, and growth projections to build trust and credibility with investors. Be upfront about any potential risks, challenges, or uncertainties associated with the investment opportunity, as transparency is essential for establishing a strong foundation for the investment relationship. By being open and honest in your communication with investors, you can demonstrate your integrity and commitment to building a successful partnership.

Focus on Win-Win Solutions

Negotiations with investors should focus on creating mutually beneficial terms that align the interests of both parties. Seek to develop win-win solutions that offer value to the investor while supporting the growth and success of your company. By demonstrating a willingness to collaborate, compromise, and find common ground, you can build a positive rapport with investors and lay the groundwork for a productive and harmonious investment relationship. Look for ways to structure the deal in a manner that maximizes value for all parties involved, creating a partnership that is based on shared goals and mutual benefit.

Seek Legal Advice

When negotiating terms with investors, it is essential to seek legal advice to ensure that the terms of the investment contract are fair, reasonable, and legally enforceable. Legal advisors can help you navigate complex legal issues, assess the implications of different terms, and protect your interests throughout the negotiation process. By consulting with legal experts, you can ensure that the investment agreement complies with applicable laws and regulations, mitigates legal risks, and safeguards your rights as a company founder or entrepreneur. Legal advice is critical for ensuring that the investment transaction is conducted in a legally compliant and secure manner

Document the Agreement

Once the terms of the investment have been negotiated and agreed upon, it is essential to document the agreement in writing to formalize the investment contract. The investment contract should detail all the terms and conditions of the agreement, including the investment amount, ownership stakes, control rights, exit strategies, and any other specific provisions agreed upon by both parties. Having a written agreement helps prevent misunderstandings, disputes, and discrepancies that may arise in the future, providing a clear roadmap for how the investment relationship will be structured and managed.

Review and Revise as Needed

It is important to review and revise the investment contract as needed to ensure that it accurately reflects the terms and conditions agreed upon by both parties. This may involve seeking feedback from legal advisors, financial experts, or other relevant stakeholders to ensure that the contract is comprehensive, clear, and enforceable. By conducting a thorough review of the investment contract, you can identify any potential issues, gaps, or inconsistencies that need to be addressed before finalizing the agreement. Revising the contract as needed helps protect the interests and rights of all parties involved, ensuring that the investment transaction proceeds smoothly and effectively.

Get Signatures and Execute the Agreement

Once the investment contract has been finalized and reviewed, it is time to get signatures from both parties and formally execute the agreement. Signing the investment contract signifies the mutual agreement and acceptance of the terms and conditions laid out in the document, creating a legally binding relationship between the investor and the company. Executing the agreement in a timely and professional manner helps establish trust, credibility, and commitment between the parties, setting the stage for a successful and productive investment partnership. It is essential to keep a copy of the signed agreement for record-keeping purposes and future reference.

What to Include in an Investor Agreement?

An investor agreement, which is a key component of an investment contract, outlines the specific terms and conditions of the investment relationship between the investor and the company. Here are some essential elements that should be included in an investor agreement:

Investment Amount

Specify the total amount of funding to be provided by the investor and the terms of payment, including any milestones or tranches for disbursement. Clearly outline the payment schedule, investment timeline, and any conditions or requirements for accessing the funds. By defining the investment amount upfront, both parties can align their expectations and commitments regarding the financial aspect of the investment.

Ownership Stakes

Define the percentage of equity ownership or voting rights that the investor will receive in exchange for the investment. Outline the terms of the equity stake, including any voting rights, dividend preferences, or other shareholder privileges. It is essential to clearly specify the ownership structure and rights of the investor to ensure that both parties understand their respective roles and responsibilities within the company.

Control Rights

Outline the investor’s rights to participate in decision-making processes, receive information, and influence key strategic decisions of the company. Define the extent of the investor’s control rights, including board representation, voting rights, approval thresholds, and involvement in major business decisions. By clarifying the control rights of the investor, both parties can establish a transparent governance framework that supports effective communication and collaboration.

Exit Strategies

Detail the options available to the investor to exit the investment, such as selling their shares, initiating a buyback, or participating in an IPO or acquisition. Specify the terms and conditions under which the investor can exit the investment, including any restrictions, rights of first refusal, or tag-along provisions. By addressing exit strategies upfront, both parties can plan for potential liquidity events and ensure that the investment can be exited in a manner that maximizes value and minimizes risks.

Confidentiality and Non-Disclosure

Include provisions to protect sensitive information and intellectual property shared during the investment process. Define the confidentiality obligations of both parties, including restrictions on disclosing confidential information to third parties or using it for unauthorized purposes. By incorporating confidentiality and non-disclosure provisions in the investor agreement, both parties can safeguard valuable proprietary information and trade secrets, protecting the competitive advantage of the company and preserving the trust and integrity of the investment relationship.

How to Manage Investor Relations After Agreement Signing

Once the investment agreement is signed, it is essential for companies to effectively manage investor relations to foster trust, communication, and transparency with their investors. Here are some tips for managing investor relations after the agreement is finalized:

Regular Updates

Provide investors with timely and relevant updates on the company’s progress, financial performance, key milestones, and strategic developments. Communication is key to maintaining a strong relationship with investors, so keeping them informed about the company’s activities, achievements, and challenges is essential. Regular updates can help build trust, demonstrate transparency, and show investors that their investment is being managed responsibly and effectively.

Open Communication

Maintain open lines of communication with investors, addressing their concerns, questions, and feedback promptly and transparently. Encourage dialogue and feedback from investors, listening to their input and suggestions, and responding thoughtfully and respectfully. Open communication builds trust and fosters a collaborative relationship with investors, creating a positive and supportive environment for working together toward shared goals and objectives.

Investor Reporting

Establish a robust reporting framework to share financial reports, operational updates, and performance metrics with investors regularly. Providing detailed and accurate reporting allows investors to track the progress of their investment, understand the company’s financial health, and assess the impact of their funding. Investor reporting should be clear, concise, and consistent, providing investors with the information they need to make informed decisions and assess the performance of their investment.

Engagement Opportunities

Offer opportunities for investors to engage with the company’s management team, attend events, and participate in strategic discussions to build a strong relationship. Engaging investors in the company’s activities, initiatives, and decision-making processes helps create a sense of ownership and alignment with the company’s vision and goals. By involving investors in meaningful ways, such as inviting them to meetings, conferences, or networking events, companies can strengthen the bond with their investors and demonstrate their commitment to collaboration and partnership.

Resolution of Issues

Address any issues or conflicts that may arise with investors in a professional and timely manner, seeking mutually beneficial solutions to maintain trust and confidence. Disputes or disagreements can occur in any investment relationship, so it is essential to handle them with care, empathy, and respect. By proactively addressing issues, listening to concerns, and working collaboratively to find solutions, companies can demonstrate their commitment to nurturing a positive and constructive partnership with their investors. Effective conflict resolution builds trust, strengthens relationships, and enhances the overall success of the investment collaboration.

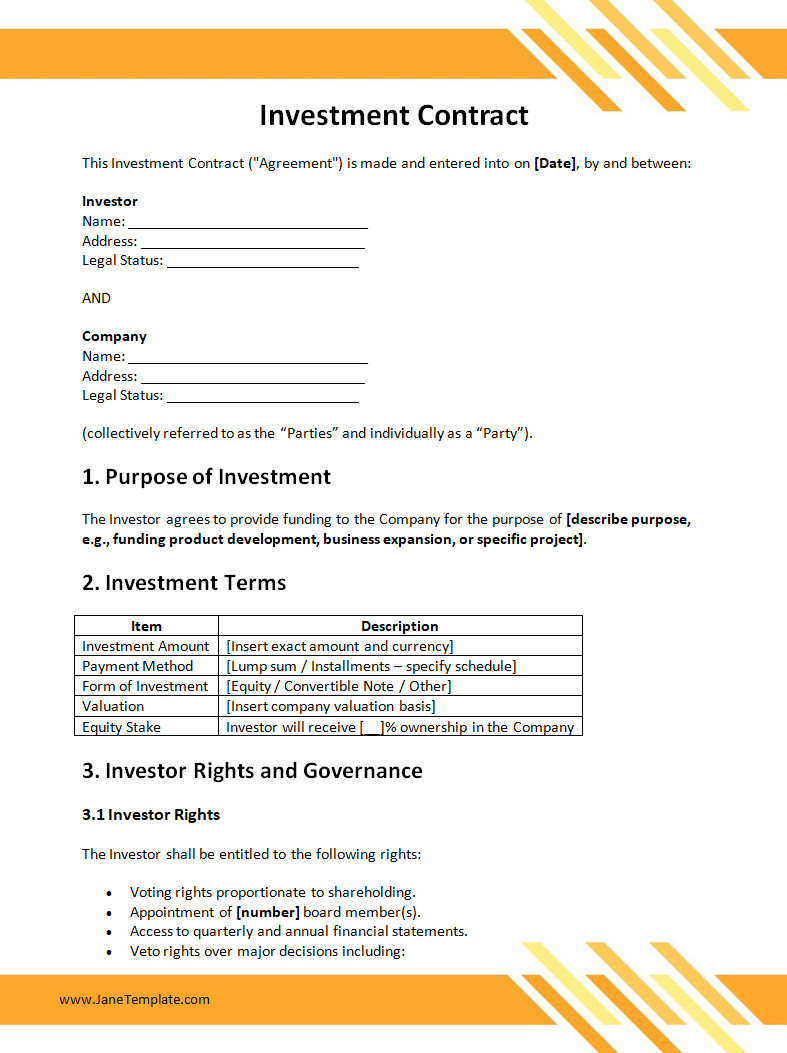

Investment Contract Template

An investment contract is an important document that outlines the terms and conditions of an investment agreement between parties. It details contributions, profit sharing, responsibilities, and exit strategies, ensuring clarity and legal protection.

To create a clear and professional agreement, use our free investment contract template and manage your investments with confidence!

Investment Contract Template – Word