Regarding real estate transactions, a house purchase agreement is a crucial document that sets the foundation for a successful sale. This legally binding contract outlines the terms and conditions of the transaction, protecting the interests of both the buyer and the seller.

By clearly defining their rights, responsibilities, and obligations, the house purchase agreement ensures a smooth and transparent process from the initial offer to the final closing.

What is a House Purchase Agreement?

A house purchase agreement, also known as a purchase and sale agreement, is a legal contract between a buyer and a seller that establishes the terms and conditions of a real estate transaction. This document outlines crucial details of the sale, including the purchase price, financing terms, inspection contingencies, and the closing date.

By signing the house purchase agreement, both parties commit to the terms outlined in the contract, creating a legally binding agreement that safeguards their interests throughout the sale process.

Importance of a House Purchase Agreement

The house purchase agreement serves as a roadmap for the sale, guiding both parties through the process while minimizing the risk of misunderstandings or disputes. By clearly documenting the terms of the transaction, the agreement helps mitigate potential conflicts and ensures that both the buyer and the seller understand their roles and responsibilities. Additionally, the house purchase agreement provides a level of legal protection for both parties, establishing a framework for a fair and transparent sale.

For buyers, the house purchase agreement offers peace of mind by specifying key details of the transaction, such as the agreed-upon purchase price and financing terms. This document also outlines any contingencies that must be met for the sale to proceed, giving buyers a clear understanding of the steps involved in the purchase process. By signing the agreement, buyers can move forward with confidence, knowing that the terms of the sale are clearly defined and agreed upon by both parties.

For sellers, the house purchase agreement helps ensure a smooth and timely sale by outlining the terms and conditions that must be met for the transaction to close. By documenting important details such as the closing date and any required repairs or improvements, sellers can avoid last-minute surprises and delays. The agreement provides sellers with a level of certainty and protection, allowing them to proceed with the sale knowing that the terms are set and agreed upon by the buyer.

Key Elements of a House Purchase Agreement

When drafting a house purchase agreement, there are several key elements that should be included to ensure that the contract is comprehensive and covers all necessary aspects of the real estate transaction.

Purchase Price

One of the most critical elements of a house purchase agreement is the purchase price of the property. The purchase price is the amount that the buyer agrees to pay for the property, and it is typically negotiated between the buyer and the seller. The purchase price should be clearly stated in the agreement, along with any specifics about how the price will be paid, such as through a mortgage, cash, or a combination of both. Including the purchase price in the house purchase agreement helps ensure that both parties are in agreement on the financial terms of the sale.

When determining the purchase price, it’s essential to consider factors such as the current market value of the property, any repairs or renovations needed, and the overall condition of the home. The purchase price should reflect the fair market value of the property and be agreed upon by both parties before finalizing the house purchase agreement. By including the purchase price in the agreement, buyers and sellers can avoid misunderstandings or disagreements about the financial terms of the sale.

Financing Terms

Another crucial element of a house purchase agreement is the financing terms of the sale. The financing terms outline how the buyer will finance the purchase of the property, including details about the down payment, mortgage amount, interest rate, and repayment schedule. These terms should be clearly stated in the agreement to ensure that both parties understand how the sale will be financed and what is required of each party during the transaction.

When including financing terms in the house purchase agreement, it’s essential to be specific and detailed about the terms of the mortgage and any other financial arrangements. Buyers should be clear about how they plan to finance the purchase and what their obligations are in terms of securing financing. Sellers should also be aware of the financing terms to ensure that the buyer is qualified and able to secure the necessary funds to complete the sale. By including financing terms in the agreement, both parties can move forward with confidence knowing that the financial aspects of the transaction are clearly defined.

Property Description

A detailed property description is another essential element of a house purchase agreement. The property description should include specific details about the property being sold, such as the address, legal description, lot size, and any improvements or additions to the property. Including a thorough property description in the agreement helps prevent misunderstandings about the property being sold and ensures that both parties have a clear understanding of what is included in the sale.

When providing a property description in the house purchase agreement, it’s important to be as detailed and specific as possible. Include information about the property’s features, such as the number of bedrooms and bathrooms, the size of the lot, and any amenities or special characteristics. Buyers should review the property description carefully to ensure that it accurately reflects the property they are purchasing, while sellers should provide accurate and complete information to avoid any disputes about the property’s condition or features.

Contingencies

Contingencies are conditions that must be met for the sale to proceed, and they are an essential element of a house purchase agreement. Common contingencies include a satisfactory home inspection, appraisal, or financing approval. Including contingencies in the agreement helps protect both parties by allowing them to back out of the sale if certain conditions are not met. Contingencies provide a level of flexibility and assurance for both buyers and sellers during the transaction.

When including contingencies in the house purchase agreement, it’s important to be specific about the conditions that must be met for the sale to move forward. Clearly outline what will happen if a contingency is not satisfied, such as whether the sale will be canceled or renegotiated. Buyers should carefully consider which contingencies are essential for their protection, while sellers should be aware of any potential risks associated with contingencies and how they may impact the sale.

Closing Date

The closing date is the date on which the sale will be finalized, and ownership of the property will transfer from the seller to the buyer. Including a closing date in the house purchase agreement is essential for both parties to have a clear timeline for completing the transaction. The closing date should be agreed upon by both parties and should allow sufficient time for any necessary steps to be completed before the sale is finalized.

When setting a closing date in the house purchase agreement, it’s important to consider factors such as the time needed for loan approval, inspections, and appraisals. Buyers should ensure that they have enough time to secure financing and complete any required steps before the closing date. Sellers should also be prepared to meet any obligations before the closing date to ensure a smooth and timely sale. Including a closing date in the agreement helps provide clarity and structure to the sale process, allowing both parties to plan accordingly.

Deposit

The deposit, also known as earnest money, is an amount of money that the buyer puts down as a show of good faith to secure the sale. Including details about the deposit in the house purchase agreement helps demonstrate the buyer’s commitment to the transaction and assures the seller that the buyer is serious about purchasing the property. The deposit is typically held in escrow until the sale is finalized, at which point it may be applied to the purchase price.

When specifying the deposit in the house purchase agreement, it’s essential to outline the amount of money to be deposited and any conditions under which the deposit may be returned to the buyer. Buyers should be aware of the deposit requirements and ensure that they have the necessary funds available to meet this obligation.

How to Draft a House Purchase Agreement

Here are some key steps to consider when drafting a house purchase agreement:

Consult with Both Parties

Before drafting the house purchase agreement, it’s essential to consult with both the buyer and the seller to ensure that their interests and concerns are addressed in the contract. By discussing the key terms and conditions of the sale with both parties, you can identify any specific needs or requirements that should be included in the agreement. Open communication between the buyer, seller, and any real estate agents or attorneys involved can help ensure that the agreement reflects the expectations and intentions of all parties.

During the consultation process, it’s important to address any questions or concerns that either party may have about the terms of the sale. This is an opportunity to clarify any misunderstandings, negotiate terms, and make revisions to the agreement as needed. By involving both parties in the drafting process, you can create a more collaborative and transparent agreement that lays the groundwork for a successful transaction.

Review Local Laws and Regulations

Before finalizing the house purchase agreement, it’s crucial to review local laws and regulations that may impact the sale. Real estate laws can vary by state or region, so it’s important to ensure that the agreement complies with any legal requirements specific to the location of the property. Consulting with a real estate attorney can help ensure that the agreement is legally sound and that all necessary elements are included to protect both parties.

Reviewing local laws and regulations can also help identify any additional documents or disclosures that may be required as part of the sale process. For example, some states may have specific requirements for property disclosures or lead-based paint disclosures that must be included in the agreement. By conducting a thorough review of local laws and regulations, you can ensure that the house purchase agreement is compliant and that the sale proceeds smoothly and in accordance with legal requirements.

Include Detailed Property Information

One of the most critical aspects of a house purchase agreement is the detailed property information included in the contract. This information should provide a comprehensive description of the property being sold, including details about the location, size, condition, and any included fixtures or appliances. By including detailed property information in the agreement, both parties can have a clear understanding of the property being sold and what is included in the sale.

When including property information in the house purchase agreement, it’s essential to be specific and detailed about the condition of the property and any included items. Buyers should review the property information carefully to ensure that it accurately reflects the property they are purchasing, while sellers should provide accurate and complete information to avoid any disputes about the property’s condition or features. Including detailed property information helps prevent misunderstandings and ensures that both parties are in agreement on the specifics of the sale.

Outline Financial Terms

Another crucial element of a house purchase agreement is outlining the financial terms of the sale. This includes details about the purchase price, financing terms, deposit requirements, and any additional costs or fees associated with the transaction. By clearly outlining the financial terms in the agreement, both parties can have a clear understanding of their financial obligations and how the sale will be financed.

When outlining financial terms in the house purchase agreement, it’s important to be specific about the purchase price, any additional costs, and how the sale will be financed. Buyers should ensure that they understand their financial obligations and have the necessary funds available to complete the transaction. Sellers should also be aware of the financial terms to ensure that the buyer is qualified and able to secure the necessary funds to purchase the property. By including detailed financial terms in the agreement, both parties can proceed with confidence knowing that the financial aspects of the sale are clearly defined.

Specify Closing Process

The closing process is a critical step in finalizing a real estate transaction, and it’s important to specify the closing process in the house purchase agreement. This includes details about the closing date, any required inspections or repairs, and the transfer of ownership from the seller to the buyer. By specifying the closing process in the agreement, both parties can have a clear understanding of the steps involved in completing the sale.

When specifying the closing process in the house purchase agreement, it’s essential to include the closing date and any deadlines that must be met before the sale is finalized. Buyers should be prepared to complete any required inspections or repairs before the closing date, while sellers should ensure that all necessary documents are ready for transfer to the buyer. By specifying the closing process in the agreement, both parties can work together to ensure a smooth and timely completion of the sale.

Include Contingency Plans

Contingency plans are essential in a house purchase agreement to address any unforeseen circumstances that may arise during the sale process. Common contingencies include a satisfactory home inspection, appraisal, or financing approval, but buyers and sellers may also include additional contingencies based on their specific needs and concerns. By including contingency plans in the agreement, both parties can have a plan of action if certain conditions are not met.

When including contingency plans in the house purchase agreement, it’s important to be specific about what will happen if a contingency is not satisfied. Outline any steps that must be taken to address the issue, such as renegotiating the terms of the sale or canceling the agreement. Buyers should consider which contingencies are essential for their protection, while sellers should be aware of how contingencies may impact the sale. By including contingency plans in the agreement, both parties can proceed with confidence knowing that they have a plan in place for any unexpected challenges.

Review and Negotiate Terms

After drafting the house purchase agreement, it’s essential to review and negotiate the terms of the contract with the buyer and seller. This is an opportunity to ensure that both parties are in agreement on all terms and conditions of the sale and to address any questions or concerns that may arise. Reviewing the agreement together allows both parties to clarify any misunderstandings, negotiate changes to the terms, and ensure that the document accurately reflects their intentions and expectations.

During the review and negotiation process, it’s important to be open to feedback and willing to make revisions to the agreement as needed. Both the buyer and the seller should feel comfortable expressing their concerns and discussing any aspects of the sale that may need further clarification. By working together to review and negotiate the terms of the agreement, both parties can ensure that their interests are protected and that the contract accurately reflects the terms of the sale.

Once any revisions have been made and both parties are in agreement on the terms of the house purchase agreement, the document can be finalized and signed. It’s important for both the buyer and the seller to carefully read and understand the agreement before signing to ensure that all terms and conditions are clear and acceptable. By signing the house purchase agreement, both parties commit to the terms outlined in the contract and move forward with confidence in the sale process.

Tips for a Successful House Purchase Agreement

When drafting a house purchase agreement, there are several tips to keep in mind to ensure a successful and smooth transaction for both the buyer and the seller. By following these tips, both parties can create a comprehensive and legally binding contract that protects their interests and facilitates a successful sale. Here are some key tips for a successful house purchase agreement:

Be Clear and Specific

One of the most important tips for a successful house purchase agreement is to be clear and specific about the terms and conditions of the sale. Avoid using ambiguous language or vague terms that may lead to misunderstandings or disputes later on. Clearly outline all aspects of the transaction, including the purchase price, financing terms, property description, contingencies, and closing date, to ensure that both parties have a clear understanding of their rights and responsibilities.

By being clear and specific in the house purchase agreement, both the buyer and the seller can proceed with confidence knowing that the terms of the sale are accurately reflected in the contract. Avoiding confusion or misinterpretation of the agreement helps prevent potential disputes and ensures a smooth and transparent transaction for all parties involved.

Include Contingencies

Another important tip for a successful house purchase agreement is to include contingencies that protect both parties during the sale process. Contingencies are conditions that must be met for the sale to proceed, such as a satisfactory home inspection, appraisal, or financing approval. By including contingencies in the agreement, buyers and sellers can have a plan of action if certain conditions are not met, providing a level of flexibility and assurance during the transaction.

When including contingencies in the house purchase agreement, it’s essential to be specific about the conditions that must be satisfied for the sale to move forward. Clearly outline what will happen if a contingency is not met, such as whether the sale will be canceled or renegotiated. By including contingencies in the agreement, both parties can proceed with confidence knowing that they have a plan in place for any unexpected challenges that may arise.

Consult with Professionals

Consulting with real estate professionals, such as real estate agents, attorneys, or mortgage brokers, can be beneficial when drafting a house purchase agreement. These professionals can provide valuable advice and guidance on the terms of the contract, ensuring that all legal requirements are met and that the agreement protects the interests of both parties. By seeking advice from professionals, both buyers and sellers can proceed with confidence knowing that their interests are protected and that the agreement is legally sound.

Real estate professionals can also provide valuable insights and recommendations based on their experience in the industry. They can help clarify any complex legal terms or requirements in the agreement and address any concerns or questions that may arise during the drafting process. By consulting with professionals, both parties can have peace of mind knowing that their interests are protected and that the agreement accurately reflects the terms of the sale.

Negotiate in Good Faith

Negotiating in good faith is essential when drafting a house purchase agreement to ensure that both parties reach a mutually beneficial agreement. By approaching the negotiation process with honesty, transparency, and a willingness to compromise, both the buyer and the seller can work together to find common ground and finalize the terms of the sale. Negotiating in good faith helps build trust and foster a positive working relationship between the parties involved in the transaction.

During the negotiation process, it’s important to be open to feedback and willing to make concessions to reach a fair and equitable agreement. Both parties should listen to each other’s concerns and be willing to explore different options to find a solution that meets their needs. By negotiating in good faith, both the buyer and the seller can move forward with confidence knowing that the terms of the agreement are fair and acceptable to all parties.

Review and Understand the Agreement

Before signing the house purchase agreement, it’s essential for both the buyer and the seller to carefully review and understand all aspects of the contract. Take the time to read through the agreement in detail, paying close attention to the terms and conditions, contingencies, and any other key elements of the sale. If any provisions are unclear or require further explanation, seek clarification from a real estate professional or attorney before signing the agreement.

By reviewing and understanding the agreement before signing, both parties can ensure that they agree on all terms and conditions of the sale. If there are any areas of concern or disagreement, address these issues before finalizing the agreement to avoid potential disputes later on. By taking the time to review and understand the agreement, both the buyer and the seller can proceed with confidence knowing that the terms of the sale are clear and acceptable.

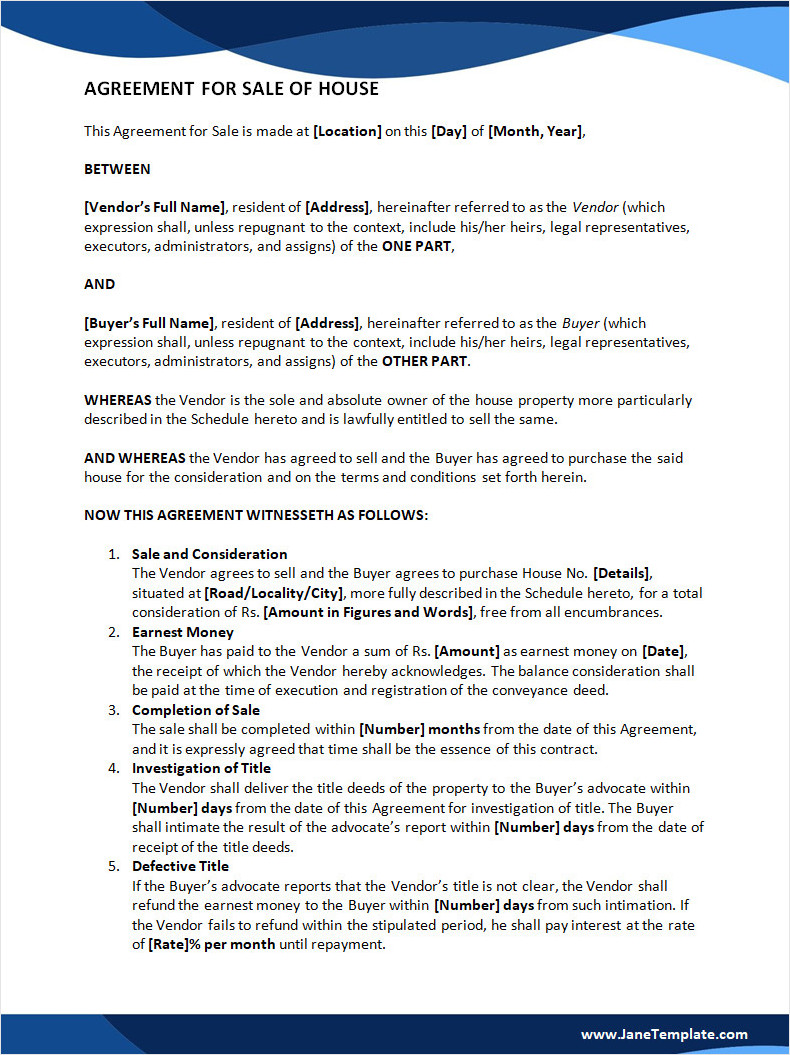

House Purchase Agreement Template

A house purchase agreement is an essential tool for outlining the terms and conditions of a property sale between a buyer and a seller. It defines the purchase price, contingencies, and responsibilities, ensuring both parties are legally protected.

To make property transactions smooth and secure, use our free house purchase agreement template and set clear terms with confidence!

House Purchase Agreement Template – Word