Understanding how a loan amortization schedule works is crucial for both borrowers and lenders. It provides a clear breakdown of how a loan is paid off over time, showing the portion of each payment that goes towards principal and interest.

This tool helps individuals budget, track loan progress, understand the total cost of borrowing, and strategize on how to pay off the loan more quickly by making extra payments.

What is a Loan Amortization Schedule?

A loan amortization schedule is a table that breaks down each periodic payment made towards a loan, detailing the amount allocated to principal repayment and interest payment. It helps borrowers visualize how their loan balance decreases over time, making it easier to plan their finances.

Lenders also benefit from this schedule as it helps them predict cash flows and assess the risk associated with the loan.

Why is a Loan Amortization Schedule Important?

A loan amortization schedule is essential for both borrowers and lenders for several reasons:

Effective Budgeting

One of the primary benefits of a loan amortization schedule is its role in effective budgeting. By knowing exactly how much of each payment goes towards principal and interest, borrowers can plan their monthly finances more accurately. This visibility helps borrowers avoid financial surprises and stay on track with their repayment plan.

Transparency in Loan Progress

Another key advantage of a loan amortization schedule is the transparency it provides in tracking loan progress. Borrowers can see how each payment reduces the loan balance and contributes to the eventual loan payoff. This transparency instills a sense of accomplishment and motivates borrowers to continue making consistent payments.

Understanding Total Cost

By detailing the total interest paid over the life of the loan, a loan amortization schedule helps borrowers understand the full cost of borrowing. This insight is crucial for making informed financial decisions and strategizing on how to minimize interest expenses by paying off the loan sooner. Understanding the total cost can also help borrowers evaluate the affordability of the loan.

Strategizing Loan Repayment

With a loan amortization schedule, borrowers can strategize on how to pay off the loan more quickly and save on interest charges. By analyzing the breakdown of each payment and the impact of extra payments, borrowers can develop a repayment strategy that aligns with their financial goals. This proactive approach can lead to significant savings in the long run.

Key Elements of a Loan Amortization Schedule

A typical loan amortization schedule includes the following key elements:

Loan Amount

The loan amount represents the total sum borrowed from the lender. This initial principal amount forms the basis for calculating the repayment schedule, including interest charges and the gradual reduction of the principal balance over time.

Interest Rate

The interest rate is the annual percentage charged by the lender for borrowing the loan amount. It plays a crucial role in determining the total cost of borrowing and influences the size of each payment in the amortization schedule. A higher interest rate leads to higher interest charges over the loan term.

Loan Term

The loan term refers to the duration over which the borrower agrees to repay the loan. Common loan terms include 15, 20, or 30 years for mortgages, while personal loans may have shorter terms. The length of the loan term affects the total interest paid and the size of each payment in the schedule.

Payment Amount

The payment amount is the total sum due for each installment, including both principal and interest components. This figure is calculated based on the loan amount, interest rate, and loan term. The payment amount remains constant throughout the loan term in fixed-rate loans but may vary in adjustable-rate loans.

Principal Payment

The principal payment represents the portion of each installment that goes towards reducing the outstanding loan balance. As borrowers make payments, the principal portion gradually decreases the amount owed. Over time, a larger share of each payment goes towards principal repayment, accelerating the loan payoff process.

Interest Payment

The interest payment is the amount allocated to covering the cost of borrowing the loan amount. In the early stages of the loan term, a significant portion of each payment goes towards interest charges. As the loan progresses, the interest portion decreases, while the principal portion increases, reflecting the reduced outstanding balance.

How to Read a Loan Amortization Schedule

Reading a loan amortization schedule may seem daunting at first, but it’s actually quite straightforward. Here’s how to make sense of the numbers:

Understanding the Payment Amount

The payment amount is the total sum due for each installment, consisting of principal and interest components. This fixed amount remains constant throughout the loan term in fixed-rate loans, making it easier for borrowers to plan their monthly budgets. By knowing the payment amount, borrowers can anticipate their financial obligations each month.

Identifying the Principal and Interest Breakdown

One of the critical aspects of a loan amortization schedule is understanding how each payment is divided between principal repayment and interest charges. By identifying the principal and interest breakdown, borrowers can see how much of each payment goes towards reducing the loan balance and covering the cost of borrowing. This breakdown helps borrowers track their progress in paying off the loan.

Tracking the Remaining Balance

Monitoring the remaining loan balance is essential for borrowers to gauge their progress towards loan payoff. As each payment reduces the outstanding balance, borrowers can see how much closer they are to becoming debt-free. This tracking mechanism provides a visual representation of loan repayment progress and motivates borrowers to continue making payments.

Analyzing the Total Interest Paid

Understanding the total interest paid over the life of the loan is crucial for borrowers to assess the overall cost of borrowing. By analyzing the total interest amount in the loan amortization schedule, borrowers can see how much they pay in addition to the principal amount. This insight can help borrowers make informed decisions about paying off the loan sooner to minimize interest expenses.

Considering Making Extra Payments

One strategy for accelerating loan payoff and saving on interest charges is to make extra payments towards the principal balance. By allocating additional funds towards the principal, borrowers can reduce the outstanding balance faster and shorten the loan term. This approach can lead to significant interest savings over the life of the loan.

Monitoring Changes in Interest and Principal Portions

As borrowers progress through the loan term, they may notice changes in the proportion of each payment allocated to interest and principal. In the initial stages of the loan, a higher percentage of each payment goes towards interest, while the principal portion is smaller. Over time, this ratio shifts as more of each payment goes towards principal repayment, reflecting the reduced outstanding balance.

Planning for Future Payments

Using the loan amortization schedule, borrowers can plan for future payments and budget accordingly. By knowing the payment amounts in advance, borrowers can ensure they have sufficient funds available to meet their financial obligations. Planning can help borrowers avoid missed payments, late fees, and other financial penalties.

Tips for Successful Loan Repayment

Here are some tips to help you successfully repay your loan:

Stick to the Payment Schedule

Consistency is key when it comes to loan repayment. Make sure to stick to the payment schedule and submit your payments on time to avoid late fees and penalties. Set up automatic payments or reminders to ensure you never miss a due date.

Consider Biweekly Payments

Switching to biweekly payments can help you pay off your loan faster and save on interest charges. By making half of your monthly payment every two weeks, you end up making one extra payment each year, accelerating the loan payoff process. This approach can significantly reduce the total interest paid over the life of the loan.

Make Extra Payments

If you have the financial flexibility, consider making extra payments towards the principal balance. Even small additional amounts can have a big impact on reducing the outstanding balance and shortening the loan term. Prioritize making extra payments to save on interest and pay off the loan sooner.

Refinance at a Lower Rate

If interest rates have dropped since you took out the loan, consider refinancing to secure a lower rate. Refinancing can lower your monthly payments, reduce the total interest paid, and potentially shorten the loan term. Be sure to analyze the costs and benefits of refinancing before making a decision.

Review Your Budget Regularly

Keep a close eye on your budget and expenses to ensure you can comfortably make loan payments. Regularly review your finances and adjust your budget as needed to prioritize loan repayment. Cut unnecessary expenses and allocate more funds towards paying off the loan to expedite the process.

Consult a Financial Advisor

If you’re facing challenges with loan repayment or need guidance on managing your finances, consider consulting a financial advisor. An expert can help you create a personalized repayment plan, explore debt consolidation options, and provide valuable insights on optimizing your financial strategy.

Set Financial Goals

Establish clear financial goals to stay motivated during the loan repayment journey. Whether it’s paying off the loan by a certain date, saving a specific amount on interest charges, or achieving financial freedom, having tangible goals can help you stay focused and committed to your repayment plan.

Track Your Progress

Monitor your loan amortization schedule regularly to track your progress towards loan payoff. Seeing how each payment reduces the outstanding balance and contributes to your financial goals can provide a sense of accomplishment and motivation. Celebrate milestones along the way to stay motivated.

Consider Loan Forgiveness Programs

If you have federal student loans, explore loan forgiveness programs that may be available based on your profession or circumstances. Loan forgiveness can help you reduce or eliminate your remaining loan balance, providing financial relief and supporting your long-term financial goals.

Stay Informed About Loan Terms

Understand the terms and conditions of your loan agreement to avoid any surprises or penalties. Be aware of any prepayment penalties, late fees, or changes in interest rates that may affect your repayment plan. Stay informed about your loan terms to make informed decisions.

Seek Support from Loan Servicers

If you encounter financial difficulties or challenges in making payments, reach out to your loan servicer for assistance. They may offer options such as deferment, forbearance, or income-driven repayment plans to help you manage your loan obligations during difficult times. Communication is key in finding solutions.

Celebrate Milestones

Recognize and celebrate milestones in your loan repayment journey to stay motivated and encouraged. Whether it’s reaching a certain percentage of loan payoff, making consistent payments for a set period, or achieving a specific financial goal, acknowledge your progress and use it as inspiration to continue moving forward.

Stay Committed to Financial Wellness

Loan repayment is a crucial component of your financial wellness journey. Stay committed to managing your finances responsibly, making timely payments, and prioritizing debt reduction. Building good financial habits and staying disciplined in your repayment efforts will set you on the path to financial success.

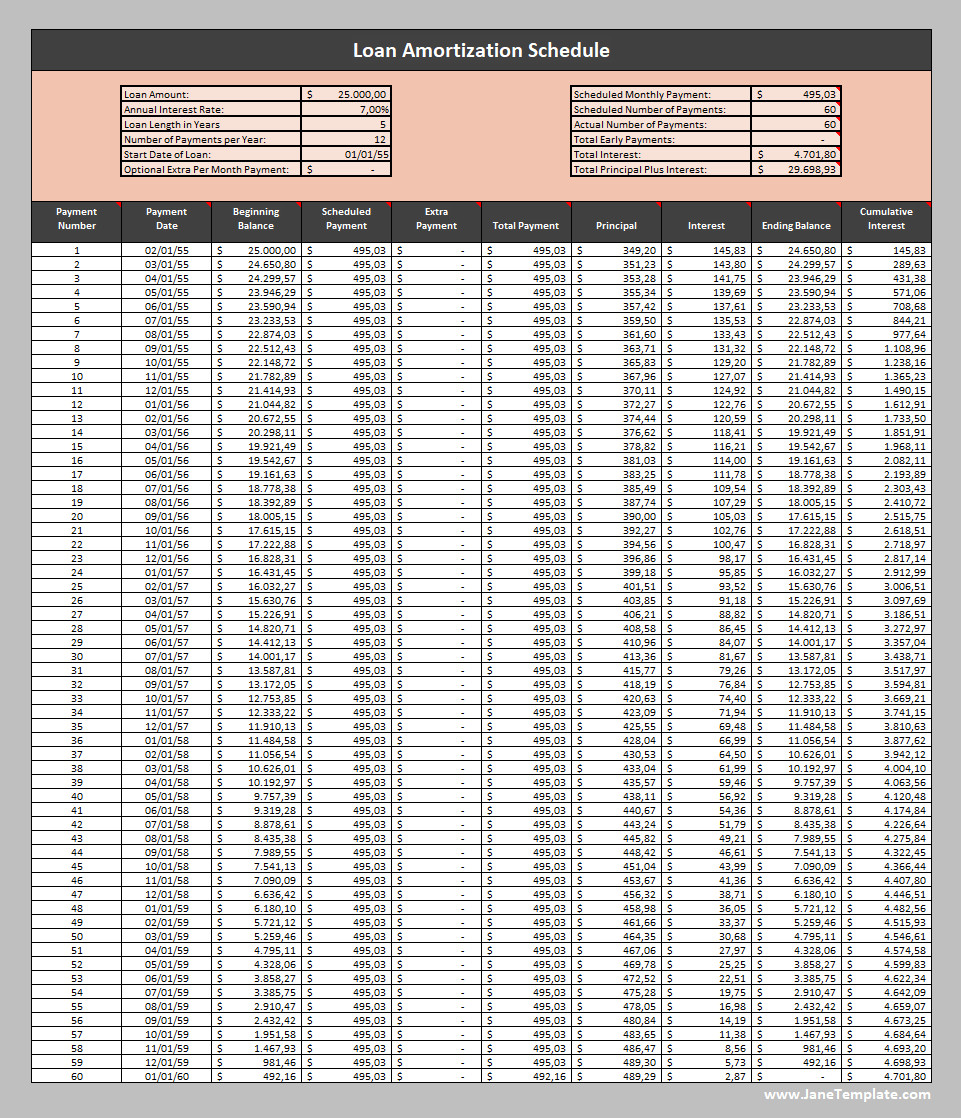

Loan Amortization Schedule Template

A loan amortization schedule is a valuable financial tool that helps you track loan payments over time, showing how each payment is divided between principal and interest. It provides a clear breakdown of your repayment progress, helping you manage debt and plan finances effectively. Ideal for personal, business, or mortgage loans, this template promotes transparency and smart budgeting.

Download and use our free loan amortization schedule template today to organize your loan details, monitor payments, and stay in control of your finances.

Loan Amortization Schedule Template – EXCEL