Keeping track of your finances is crucial for managing your budget and staying on top of your expenses. One way to stay organized is by using a monthly statement of account.

In this comprehensive guide, we will explore what a monthly statement of account is, why it is important, and how you can create one for yourself. We will also provide examples and tips for successful implementation. Let’s dive in!

What is a Monthly Statement of Account?

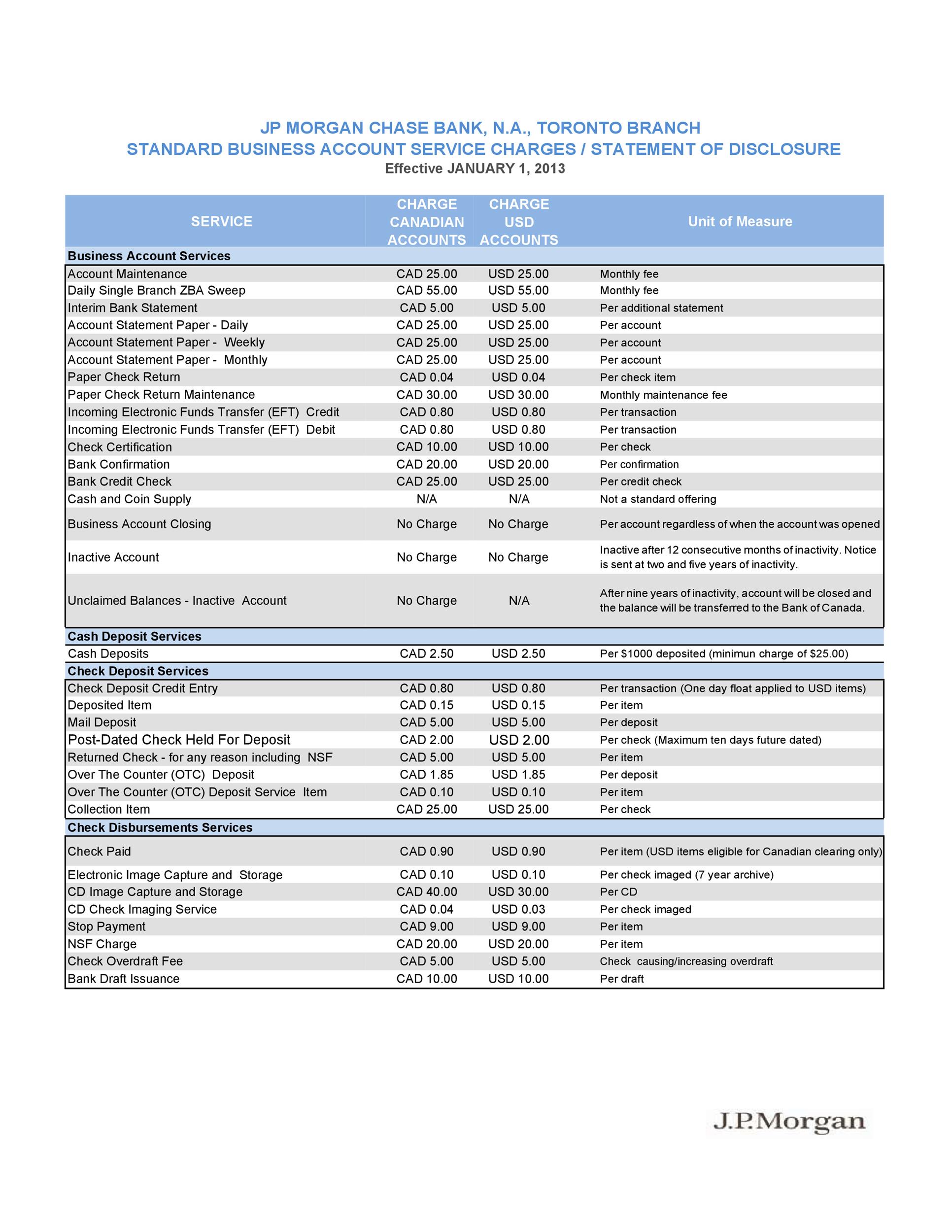

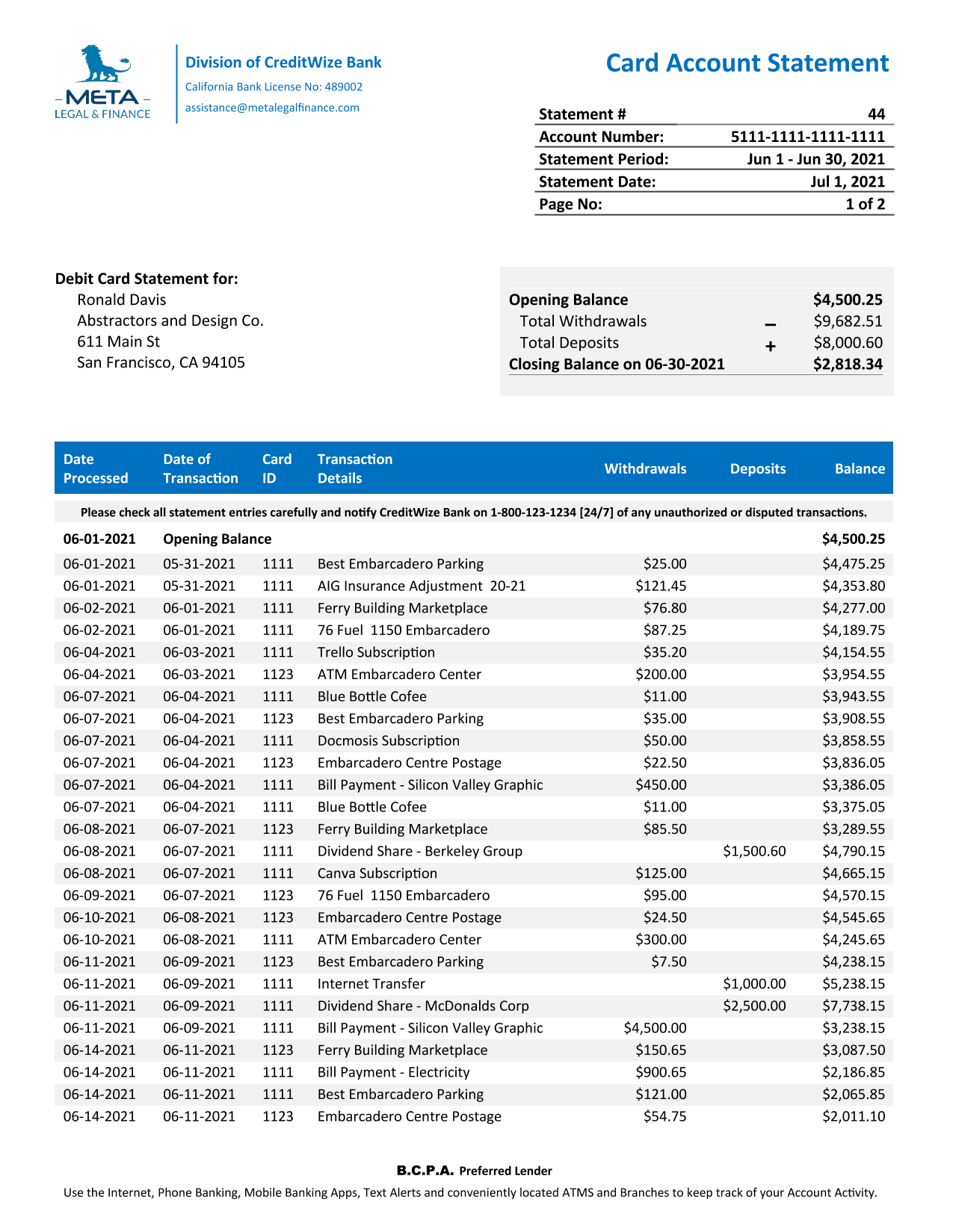

A monthly statement of account is a document that summarizes all of your financial transactions for a specific month. It typically includes details such as income, expenses, account balances, and any other financial activities.

This statement provides a clear overview of your financial situation and helps you track your spending and saving habits.

Why Use a Monthly Statement of Account?

There are several benefits to using a monthly statement of account. Some of the key advantages include:

- Organization: Helps you keep track of your finances in an orderly manner.

- Budgeting: Allows you to see where your money is going and helps you plan for future expenses.

- Monitoring: Enables you to monitor your financial progress and make adjustments as needed.

- Documentation: Provides a record of your financial activities for tax or audit purposes.

How to Create a Monthly Statement of Account

Creating a monthly statement of account is easy and can be done using a spreadsheet software or a financial management tool. Follow these simple steps to get started:

- Gather Your Financial Information: Collect all your financial documents, such as bank statements, receipts, and invoices.

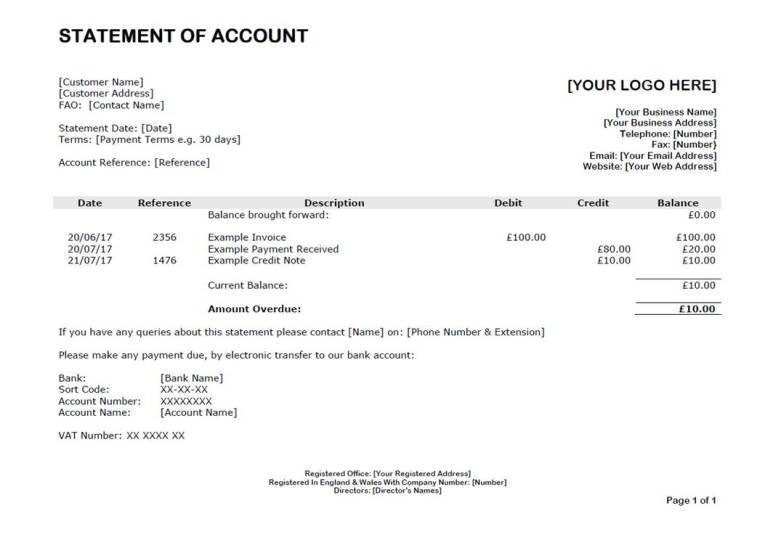

- Create a Template: Design a layout for your statement that includes sections for income, expenses, account balances, and any other relevant information.

- Input Your Data: Fill in the details of your financial transactions for the month, including dates, descriptions, and amounts.

- Review and Analyze: Take a close look at your statement to identify any trends or areas where you can improve your financial habits.

- Print and Save: Once you are satisfied with your statement, print it out and save a digital copy for future reference.

Examples of Monthly Statement of Account

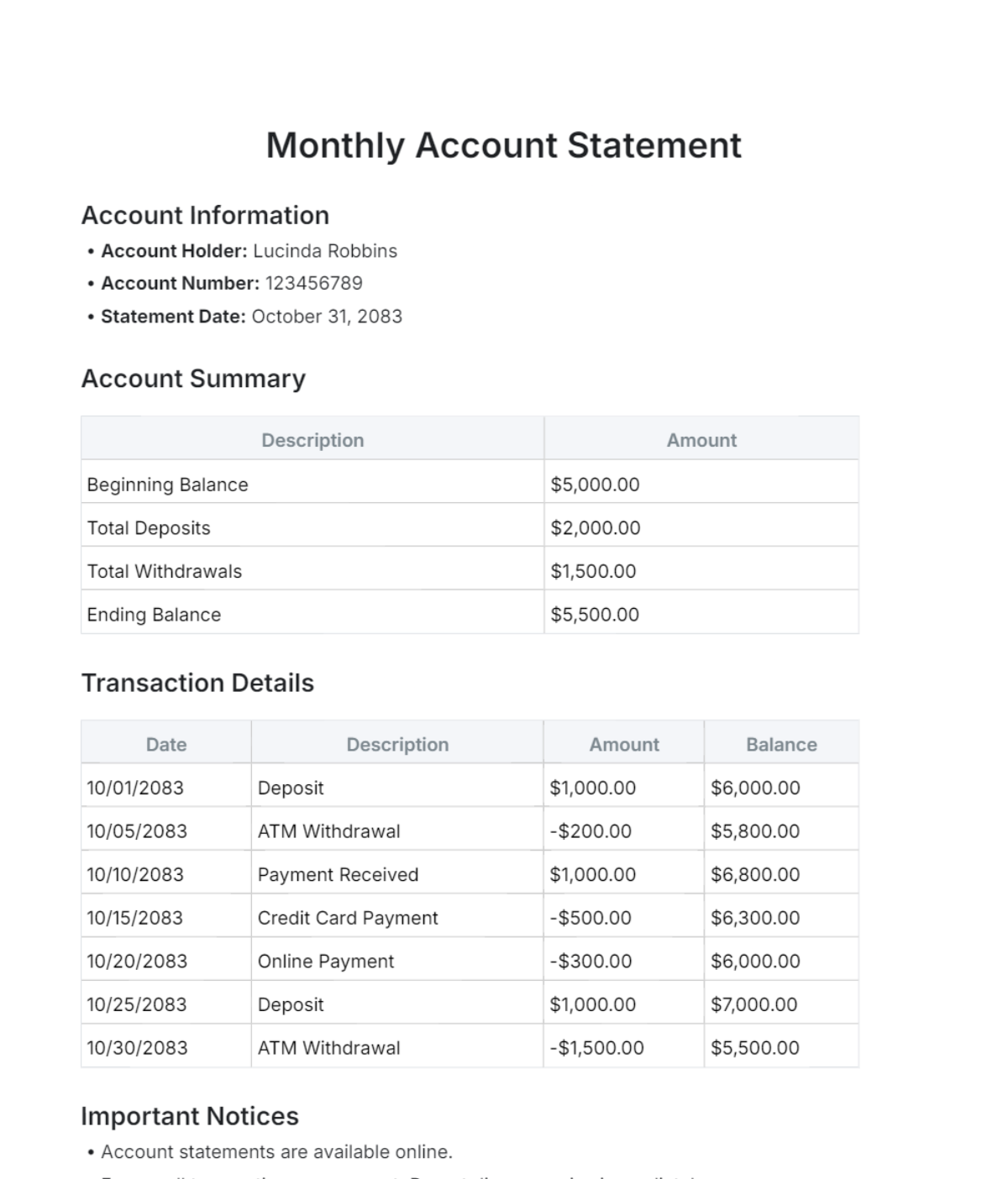

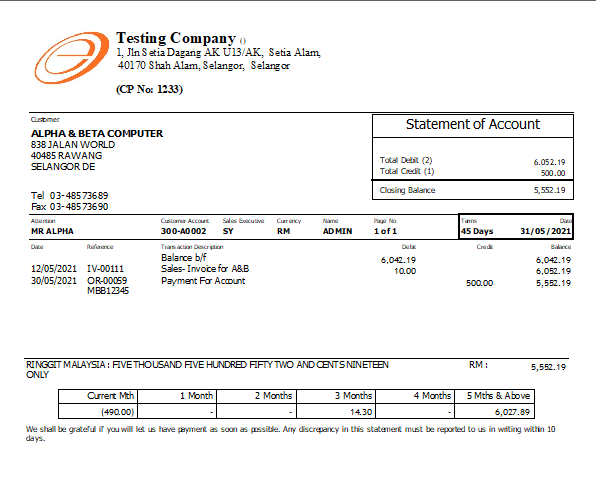

Here are a few examples of what a monthly statement of account might look like:

- Income Section: Lists all sources of income, such as salary, bonuses, and investments.

- Expenses Section: Breaks down expenses into categories like rent, utilities, groceries, and entertainment.

- Account Balances: Shows the starting and ending balances for each account, including checking, savings, and credit cards.

Tips for Successful Implementation

To make the most of your monthly statement of account, consider the following tips:

- Consistency: Update your statement regularly to ensure accuracy and relevance.

- Accuracy: Double-check your data entry to avoid errors and discrepancies.

- Analysis: Use your statement to identify spending patterns and adjust your budget accordingly.

- Goal Setting: Set financial goals based on your statement to track your progress over time.

By following these guidelines, you can effectively manage your finances and stay on top of your budget with a monthly statement of account. Start creating your statement today and take control of your financial future!

Monthly Statement of Account Template – Download