In the world of non-profit organizations, having a well-structured operating budget is crucial for ensuring financial stability and success. A non-profit operating budget can serve as a valuable tool for planning and managing the organization’s finances effectively.

In this comprehensive guide, we will explore everything you need to know about non-profit operating budgets, including what they are, why they are important, how to create one, examples, and tips for successful budgeting.

What is a Non-Profit Operating Budget?

A non-profit operating budget is a financial plan that outlines the organization’s projected revenue and expenses for a specific period, typically a fiscal year. This budget serves as a roadmap for the organization’s financial activities and helps in decision-making, resource allocation, and monitoring of financial performance. It includes various components such as income sources, expenses, cash flow projections, and financial goals.

Creating a non-profit operating budget allows organizations to set clear financial objectives, track progress towards those goals, and make informed decisions to ensure financial sustainability. It also helps in identifying potential financial challenges and opportunities, enabling proactive management of the organization’s finances.

Why are Non-Profit Operating Budgets Important?

Non-profit operating budgets are essential for several reasons:

1. Financial Planning: A well-structured budget helps in planning and allocating resources effectively to support the organization’s mission and programs.

2. Decision-Making: Budgets provide valuable insights into the financial health of the organization, enabling informed decision-making.

3. Accountability: Budgets create accountability by setting clear financial goals and monitoring progress towards achieving them.

4. Transparency: Transparent budgeting practices build trust with donors, stakeholders, and the community by demonstrating responsible financial management.

5. Sustainability: Operating budgets help in ensuring the long-term financial sustainability of the organization by identifying potential risks and opportunities.

How to Create a Non-Profit Operating Budget

Creating a non-profit operating budget involves several key steps:

1. Gather Financial Information: Collect information on revenue sources, expenses, grants, donations, and other financial data.

2. Set Financial Goals: Define clear financial goals and objectives for the budget period.

3. Estimate Revenue: Project revenue from various sources such as donations, grants, fundraising events, and program fees.

4. Determine Expenses: Identify and categorize expenses, including program costs, administrative expenses, salaries, overhead, and other costs.

5. Create Cash Flow Projections: Develop cash flow projections to ensure sufficient funds are available to meet expenses.

6. Review and Adjust: Regularly review and adjust the budget based on actual financial performance and changing circumstances.

By following these steps, non-profit organizations can create a comprehensive and realistic operating budget that supports their financial goals and mission.

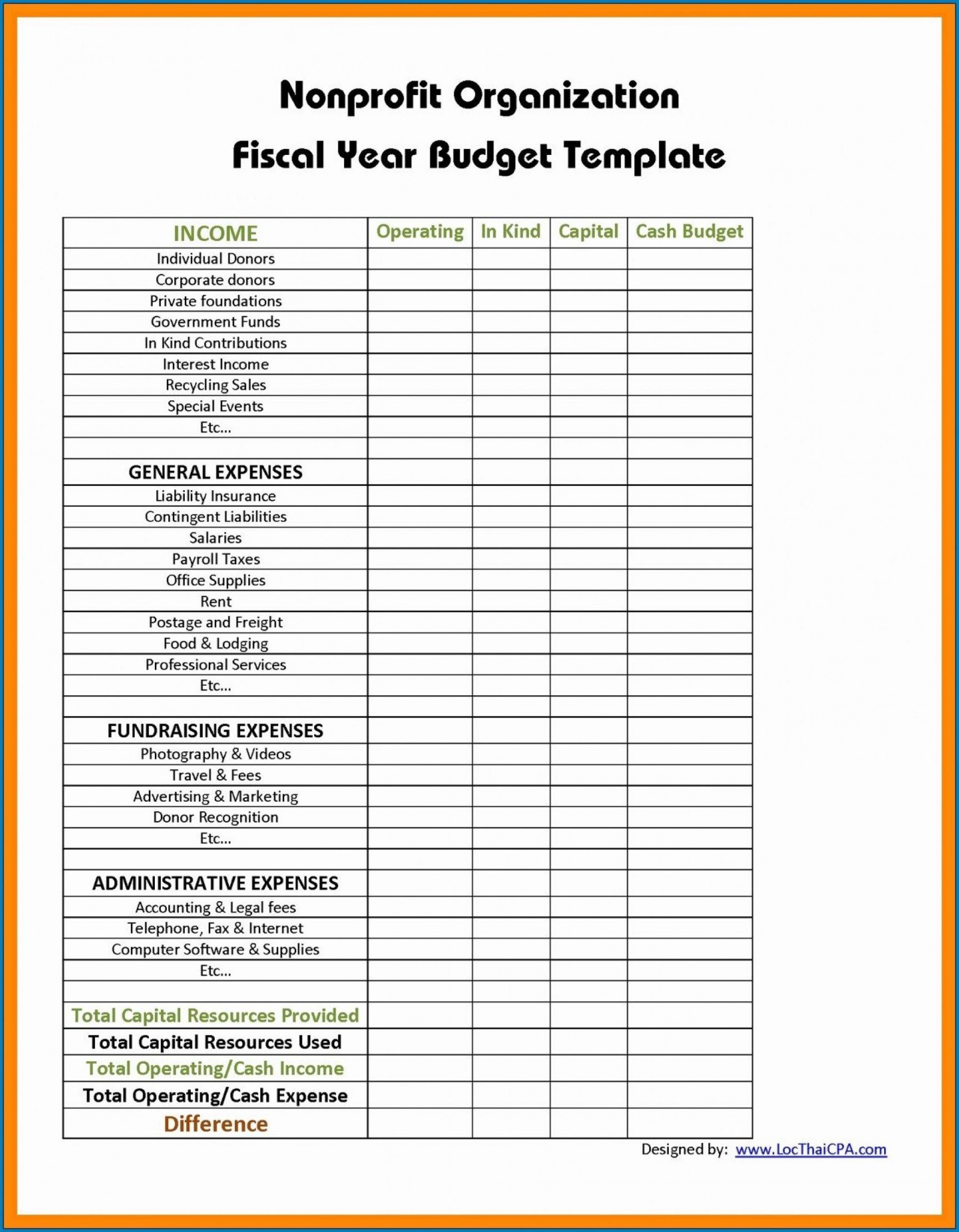

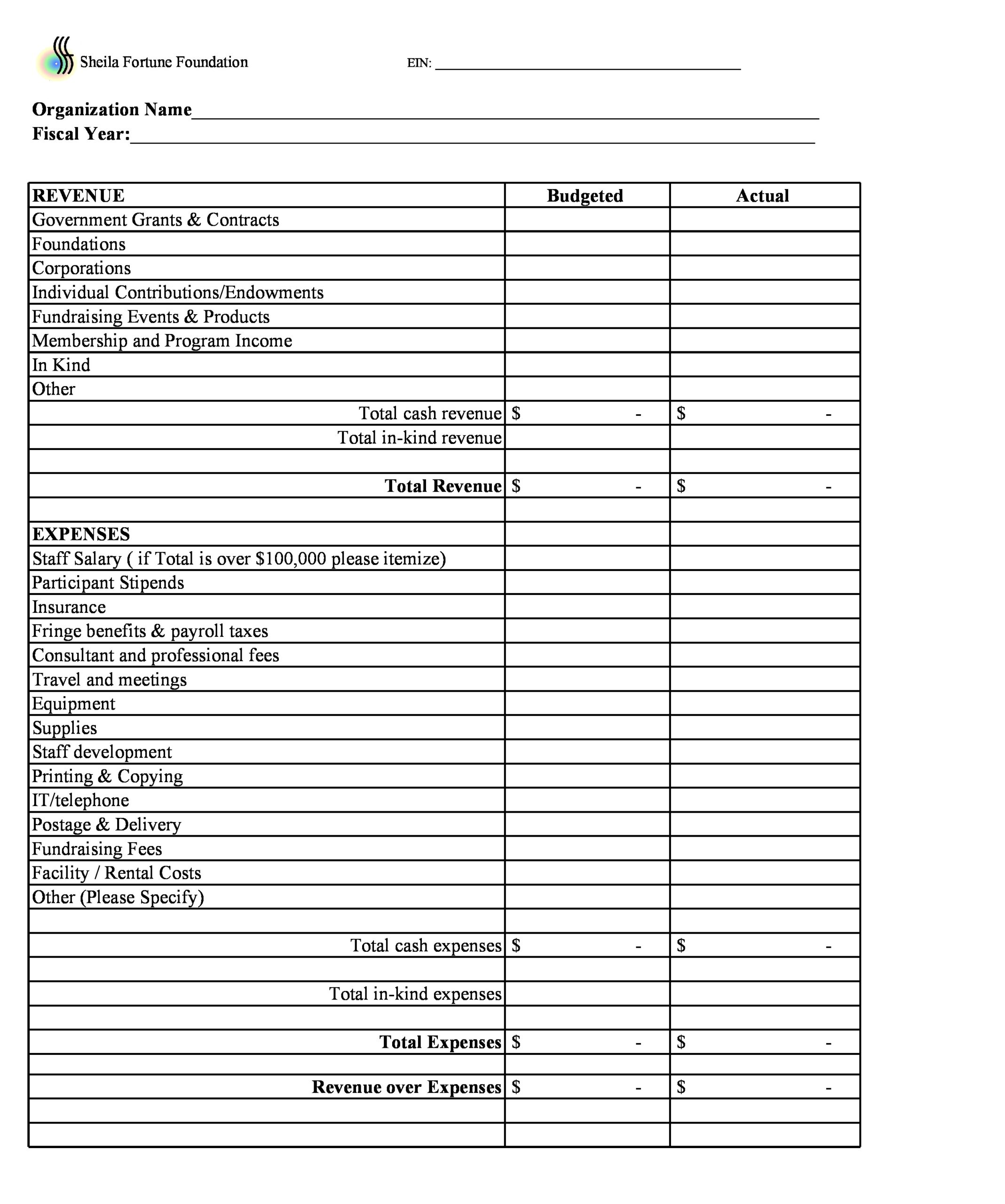

Examples of Non-Profit Operating Budgets

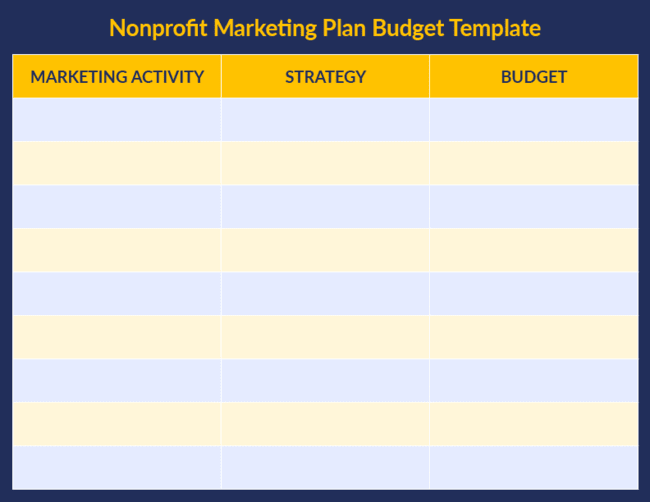

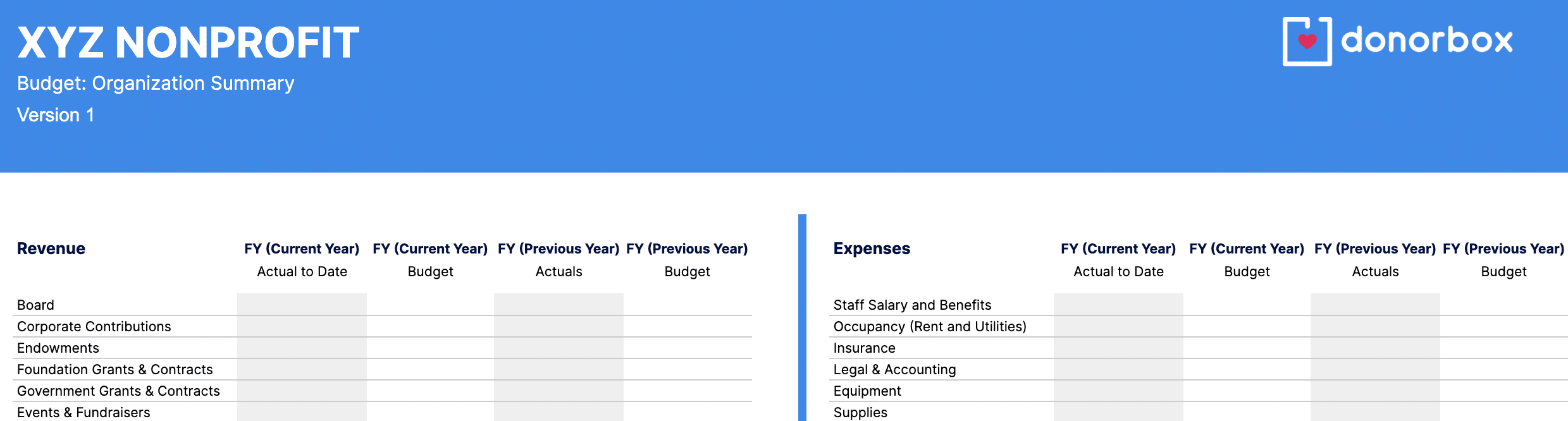

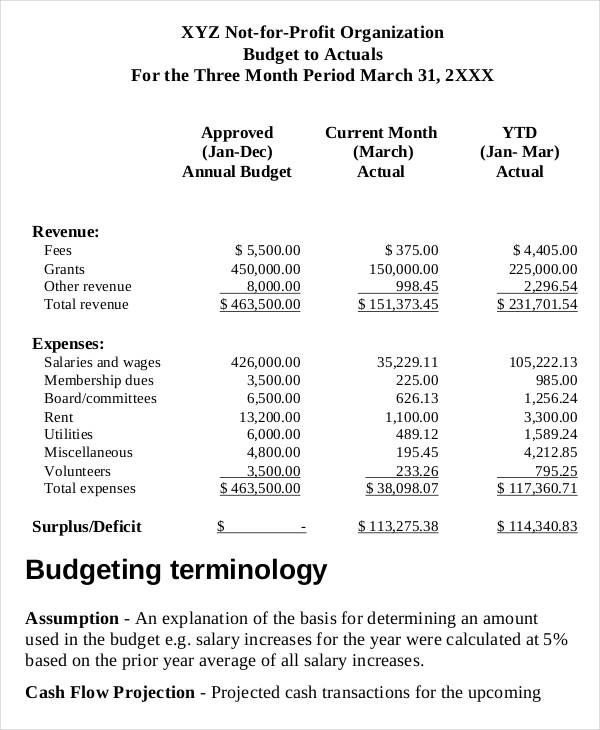

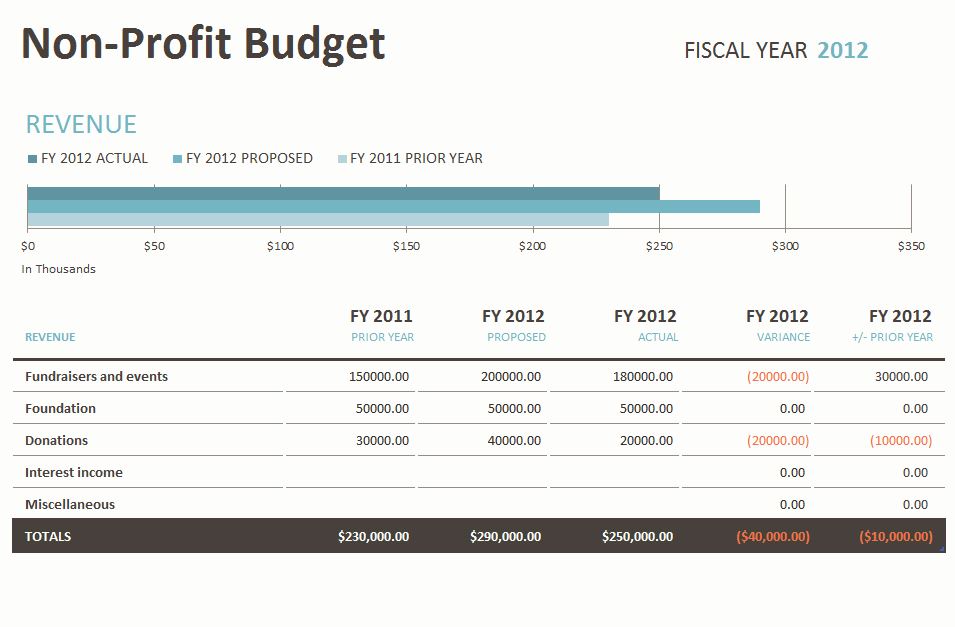

Here are a few examples of non-profit operating budgets for reference:

Tips for Successful Non-Profit Budgeting

To ensure successful budgeting for non-profit organizations, consider the following tips:

1. Involve Key Stakeholders: Engage board members, staff, volunteers, and other stakeholders in the budgeting process to gain diverse perspectives and buy-in.

2. Prioritize Mission Alignment: Align the budget with the organization’s mission and strategic priorities to ensure resources are allocated effectively.

3. Monitor and Evaluate: Regularly monitor financial performance against the budget and evaluate variances to make informed decisions.

4. Communicate Effectively: Communicate budget goals, progress, and outcomes transparently with donors, stakeholders, and the community.

5. Plan for Contingencies: Anticipate potential financial risks and uncertainties by including contingency funds in the budget.

6. Seek Professional Assistance: Consider consulting with financial experts or accountants to ensure accurate budgeting practices and compliance with regulations.

By following these tips, non-profit organizations can develop and implement successful operating budgets that support their mission and financial sustainability.

In conclusion, non-profit operating budgets play a vital role in the financial management and success of non-profit organizations. By understanding what they are, why they are important, how to create one, examples, and tips for successful budgeting, organizations can effectively plan, manage, and monitor their finances to achieve long-term sustainability and impact.

Non-Profit Operating Budget Template – Download