In today’s fast-paced world, managing personal finances can be a daunting task. From tracking expenses to setting financial goals, individuals often find themselves overwhelmed with the complexities of financial planning. This is where a personal financial statement comes into play.

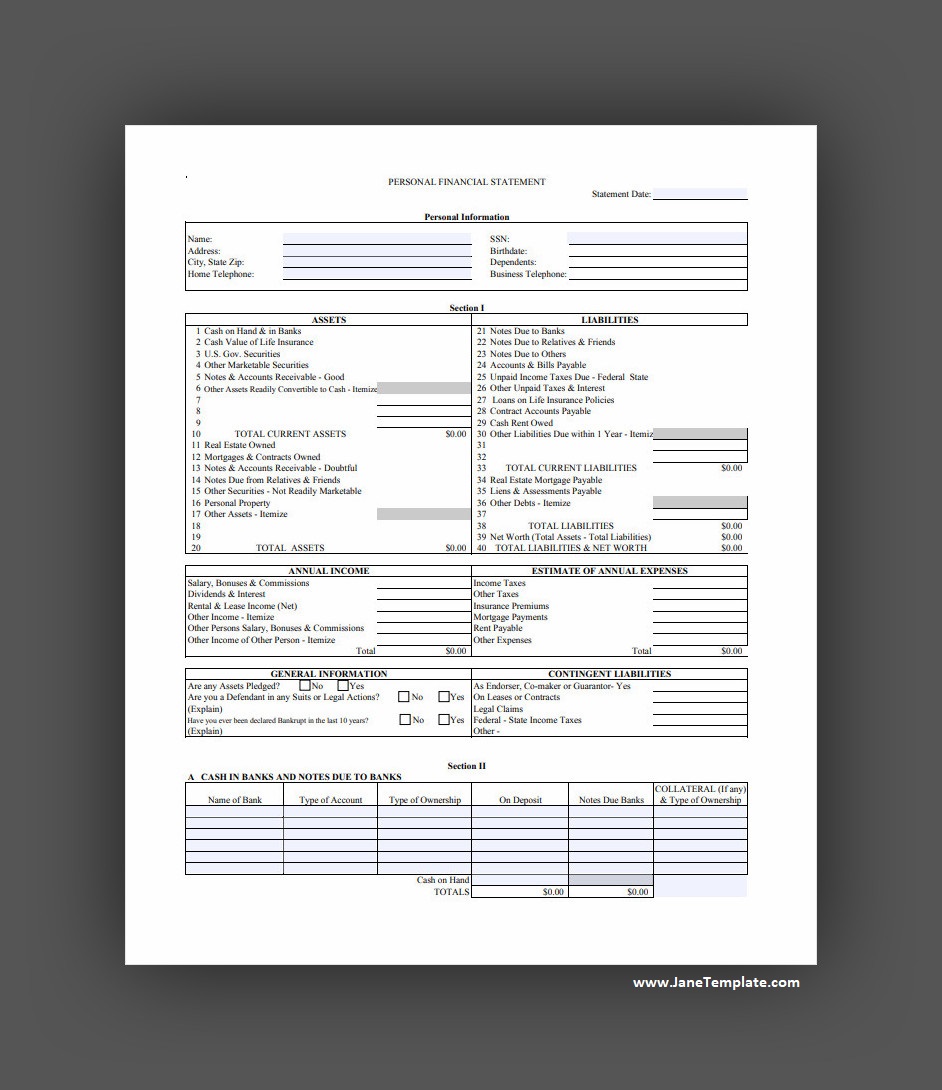

A personal financial statement, also known as a personal balance sheet, is a document that provides a snapshot of an individual’s financial health at a specific moment in time. By detailing assets, liabilities, and net worth, a personal financial statement offers a clear overview that aids in better decision-making, financial planning, and progress tracking towards financial goals.

What Is A Personal Financial Statement?

A personal financial statement is a comprehensive document that outlines an individual’s financial standing. It includes details of assets, liabilities, and net worth, providing a clear picture of one’s financial health.

- Assets refer to everything an individual owns that has value, such as cash, real estate, investments, and personal property.

- Liabilities, on the other hand, are the debts and financial obligations that one owes, including mortgages, credit card debt, and student loans.

- Net worth is calculated by subtracting total liabilities from total assets, representing the individual’s overall financial position.

Why Use A Personal Financial Statement?

A personal financial statement offers numerous benefits for individuals looking to take control of their finances. By documenting assets, liabilities, and net worth, individuals gain a holistic view of their financial situation, enabling them to make informed decisions about spending, saving, and investing. Here are some key reasons why using a personal financial statement is crucial:

- Financial Planning: A personal financial statement serves as a foundation for creating a financial plan that aligns with individual goals and aspirations.

- Budgeting: By understanding income and expenses, individuals can create a budget that helps in managing cash flow effectively.

- Debt Management: Identifying and analyzing liabilities can aid in developing strategies to reduce debt and improve financial health.

- Investment Decisions: Having a clear picture of assets can assist in making informed decisions about investments and wealth-building opportunities.

- Financial Stability: Regularly updating a personal financial statement can help in monitoring progress towards financial goals and adjusting strategies as needed.

Overall, using a personal financial statement provides individuals with the tools and insights needed to navigate the complex world of personal finance effectively.

When Do You Need A Personal Financial Statement?

A personal financial statement is valuable in various life situations and can be beneficial for individuals at different stages of their financial journey. Whether you are just starting to build your financial foundation or looking to make significant financial decisions, having a personal financial statement can be advantageous. Here are some scenarios when you may need a personal financial statement:

- Applying for Loans: Lenders often require a personal financial statement when applying for mortgages, business loans, or other forms of credit.

- Financial Planning: Creating a personal financial statement is essential for developing a comprehensive financial plan that aligns with your goals.

- Major Life Events: Events such as marriage, divorce, retirement, or inheritance may necessitate updating your personal financial statement to reflect changes in your financial situation.

- Investment Decisions: Before making investment decisions, having a clear understanding of your financial standing through a personal financial statement is crucial.

Ultimately, a personal financial statement is a versatile tool that can benefit individuals in various financial scenarios, providing clarity and direction in managing their finances effectively.

How Do I Write A Personal Financial Summary?

Creating a personal financial statement may seem like a daunting task, but with proper guidance and organization, it can be a straightforward process. Here are some steps to help you write a personal financial summary:

- Gather Financial Documents: Collect all relevant financial documents, including bank statements, investment statements, loan statements, and any other financial records.

- List Assets: Detail all assets you own, such as cash, savings accounts, retirement accounts, real estate, vehicles, and personal belongings.

- Identify Liabilities: List all outstanding debts and financial obligations, including mortgages, credit card debt, student loans, and any other liabilities.

- Calculate Net Worth: Subtract total liabilities from total assets to determine your net worth, which represents your overall financial position.

- Update Regularly: Keep your personal financial statement up to date by reviewing and revising it regularly to reflect changes in your financial status.

By following these steps and maintaining a disciplined approach to updating your personal financial statement, you can gain valuable insights into your financial health and make informed decisions to achieve your financial goals.

Personal Financial Statement Template – DOWNLOAD