When applying for a mortgage, one crucial aspect that often gets overlooked is the gift letter. A gift letter is a document that legally declares that the money provided for a mortgage down payment is a gift and does not need to be repaid.

This letter is essential for mortgage lenders to verify the source of the funds and ensure that the borrower’s ability to repay the loan is not hindered by a new, unexpected debt to the donor. Additionally, the gift letter confirms that the giver has no financial stake in the property and that the gift is being provided to help the borrower.

What is a Gift Letter for Mortgage?

A gift letter for a mortgage is a document that is used when a homebuyer receives financial assistance from a family member, friend, or another party to help with the down payment or closing costs of a home.

This letter serves as proof that the money provided is a gift and not a loan that will need to be repaid. By declaring the funds as a gift, the lender can ensure that the borrower’s financial situation remains stable and that the gift does not impact their ability to repay the mortgage.

Why is a Gift Letter Important for Mortgage Approval?

The gift letter is crucial for mortgage approval because it helps the lender verify the source of the funds. Lenders have strict guidelines in place to prevent fraud and ensure that borrowers have the financial means to repay the loan.

By providing a gift letter, the borrower can demonstrate that the funds are a gift and not an additional debt that could affect their ability to make monthly mortgage payments. This transparency gives lenders confidence in the borrower’s financial stability and can help expedite the loan approval process.

Key Elements of a Gift Letter

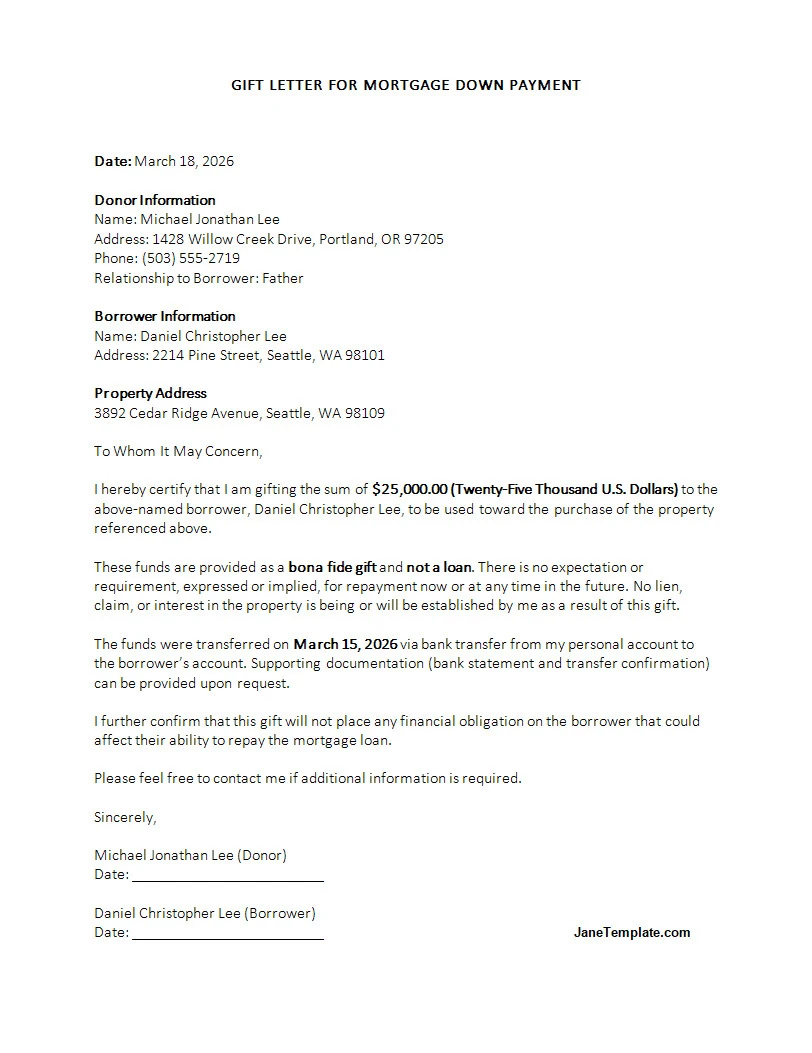

When drafting a gift letter for a mortgage, several key elements should be included to ensure its validity and effectiveness:

- Donor Information: The gift letter should include the full name, address, and relationship to the borrower of the person providing the gift.

- Borrower Information: The letter should also include the borrower’s full name, address, and the property address.

- Gift Amount: Clearly state the amount of the gift and specify whether it is for the down payment, closing costs, or both.

- Declaration of Gift: The letter should explicitly state that the funds are a gift and do not need to be repaid.

- Signatures: Both the donor and the borrower should sign the gift letter to acknowledge and confirm the gift.

How to Draft a Gift Letter for Mortgage

Creating a gift letter for a mortgage is a straightforward process, but it is essential to ensure that all necessary information is included. Here are some steps to follow when drafting a gift letter:

1. Use a Template:

Start by using a template or sample gift letter to ensure that you include all the required information and format the letter correctly.

2. Include Detailed Information:

Provide detailed information about the donor, borrower, gift amount, purpose of the gift, and any other relevant details.

3. Declare the Gift:

Clearly state in the letter that the funds are a gift and do not need to be repaid. This declaration is crucial for the lender to understand the nature of the funds.

4. Sign and Date:

Both the donor and borrower should sign and date the gift letter to confirm their agreement with the terms outlined in the letter.

5. Submit with Mortgage Application:

Include the gift letter with your mortgage application to ensure that the lender has all the necessary documentation to process your loan.

Tips for Successful Gift Letter Approval

To increase the chances of a successful gift letter approval, follow these tips:

- Start Early: Begin the gift letter process as soon as possible to avoid delays in your mortgage approval.

- Be Transparent: Provide all relevant information and documentation to the lender to demonstrate the legitimacy of the gift.

- Communicate Clearly: Ensure that the gift letter clearly states that the funds are a gift and not a loan.

- Follow Guidelines: Adhere to the lender’s requirements and guidelines for gift funds to prevent any complications during the approval process.

- Seek Professional Help: If you have any questions or concerns about the gift letter, consult with a real estate attorney or mortgage broker for guidance.

In Conclusion

A gift letter for a mortgage is a vital document that helps lenders verify the source of funds and ensure that the borrower’s financial stability is not compromised. By following the key elements and tips outlined in this article, you can streamline the gift letter process and increase your chances of mortgage approval. Remember to provide all necessary documentation and communicate openly with your lender to facilitate a smooth loan approval process.

Gift Letter Template for Mortgage – DOWNLOAD