As an independent contractor, providing services to clients is a common practice. It is essential to have a formal process in place to request payment for the work you’ve done. This is where an independent contractor invoice comes into play.

Acting as a formal billing document, the invoice details the services rendered, the agreed-upon cost, and payment terms. It serves as a crucial record for both parties involved, helping track income and maintain a professional business relationship.

What is an Independent Contractor Invoice?

An independent contractor invoice is a document that outlines the services provided by a contractor to a client. It includes essential details such as the description of the work done, the cost of the services, the payment terms, and any additional fees or expenses incurred during the project.

The invoice serves as a formal request for payment and acts as a record for both the contractor and the client.

Why is an Independent Contractor Invoice Important?

Having a formal invoice process is crucial for independent contractors for several reasons.

Establishing Professionalism

One of the primary reasons why an independent contractor invoice is important is that it helps establish professionalism in the business relationship. By providing clients with well-documented invoices that outline the services rendered, costs, and payment terms, contractors demonstrate their commitment to running a professional operation. This attention to detail can instill confidence in clients and showcase the contractor’s reliability and professionalism.

Legal Protection and Clarity

Another crucial aspect of independent contractor invoices is the legal protection they offer. In the event of a payment dispute or misunderstanding between the contractor and the client, having a detailed invoice can provide clarity on the agreed-upon terms. This can help prevent disagreements and serve as a legally binding document that outlines the services provided, costs incurred, and payment expectations.

Financial Management and Tax Compliance

Proper invoicing not only benefits the contractor and the client in terms of clarity and professionalism but also plays a significant role in financial management and tax compliance. By maintaining accurate and detailed records of invoices, contractors can track their income, expenses, and payments received. This is crucial for budgeting, financial planning, and ensuring compliance with tax regulations.

Building Trust and Long-Term Relationships

Consistent and transparent invoicing practices can also contribute to building trust and fostering long-term relationships with clients. When contractors provide clear and timely invoices that accurately reflect the services provided, clients are more likely to trust the contractor’s business practices and reliability. This trust can lead to repeat business, referrals, and positive recommendations, enhancing the contractor’s reputation in the industry.

Streamlining Payment Processes

An often overlooked benefit of using independent contractor invoices is the efficiency they bring to the payment process. By clearly outlining payment terms, due dates, and accepted payment methods on the invoice, contractors can streamline the payment process for both themselves and their clients. This can help avoid delays in receiving payments and ensure that both parties are clear on their financial obligations.

Key Elements of an Independent Contractor Invoice

When creating an independent contractor invoice, several key elements should be included to ensure clarity and transparency:

Contact Information

One of the essential elements of an independent contractor invoice is the contact information of both the contractor and the client. This includes the contractor’s name, business name (if applicable), address, phone number, and email address. Including this information ensures that both parties can easily communicate and reference the invoice as needed.

Client Information

Along with the contractor’s contact information, an independent contractor invoice should also include detailed client information. This includes the client’s name, business name, address, phone number, and email address. Having accurate client information on the invoice helps ensure that the invoice is addressed to the correct recipient and that payments are processed smoothly.

Invoice Number

Assigning a unique invoice number to each invoice is crucial for tracking and record-keeping purposes. The invoice number helps both the contractor and the client identify and reference specific invoices easily. By numbering invoices sequentially or using a coding system, contractors can organize their billing records efficiently and track payments effectively.

Services Rendered

The heart of an independent contractor invoice lies in detailing the services rendered. Contractors should provide a clear and comprehensive description of the work completed, including the scope of services, tasks performed, and any deliverables provided to the client. This section should be detailed enough for the client to understand the value of the services provided and the basis for the charges.

Cost of Services

Another critical element of an independent contractor invoice is the cost of services. Contractors should clearly outline the cost of each service provided, including hourly rates, flat fees, or project-based costs. Additionally, any taxes, fees, or expenses incurred during the project should be itemized to provide transparency and clarity to the client regarding the total amount due.

Payment Terms

Clearly defining the payment terms in an independent contractor invoice is essential for ensuring timely payments and avoiding misunderstandings. Contractors should specify the payment due date, accepted payment methods (such as bank transfer, credit card, or PayPal), and any late payment penalties or interest charges. Setting out these terms in advance helps establish expectations and prevents payment delays.

Terms and Conditions

Including any additional terms and conditions related to the services provided in the invoice can help clarify expectations and protect both parties’ interests. Contractors may choose to outline policies regarding revisions, refunds, cancellations, or intellectual property rights in this section. By setting clear terms and conditions upfront, contractors can mitigate potential disputes and ensure a smooth working relationship with their clients.

How to Create an Effective Independent Contractor Invoice

Creating an effective independent contractor invoice is essential for maintaining a professional relationship with your clients. Follow these steps to create an invoice that clearly communicates the details of the work done and the payment terms:

Use a Template

Utilizing a professional invoice template can help streamline the invoicing process and ensure that all necessary information is included. There are many free and paid invoice templates available online that cater to different industries and business needs. By using a template, contractors can save time and maintain consistency in their invoicing practices.

Be Detailed in Descriptions

Providing a clear and detailed description of the services rendered is crucial for avoiding misunderstandings and disputes. When creating an independent contractor invoice, be specific about the tasks performed, the time spent on each task, and any materials or resources used. This level of detail helps clients understand the value of the services provided and justifies the cost of the invoice.

Include Payment Terms

Clearly stating the payment terms in the invoice is essential for setting expectations and ensuring timely payments. Specify the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. By outlining these terms clearly, contractors can avoid payment delays and maintain a healthy cash flow for their business.

Proofread for Accuracy

Before sending out an independent contractor invoice to a client, it is crucial to proofread the document for accuracy and completeness. Check for any typos, errors in calculations, or missing information that could confuse. By reviewing the invoice carefully, contractors can ensure that all details are accurate and that the invoice presents a professional image to the client.

Include Contact Information

Make sure to include your contact information prominently on the invoice, including your name, business name (if applicable), address, phone number, and email address. This makes it easy for the client to reach out to you with any questions or clarifications regarding the invoice. Providing clear contact information also reinforces your professionalism and accessibility as a contractor.

Keep a Record of Invoices

After sending out an independent contractor invoice, it is essential to maintain a record of all invoices for your financial and tax records. Keep organized files or use accounting software to track invoices, payments received, and outstanding balances. Having a system in place to manage your invoicing records can help you stay on top of your finances and ensure that you are accurately tracking your income.

Follow Up on Outstanding Payments

If a client has not paid an invoice by the due date, it is important to follow up promptly to inquire about the payment status. Send a polite reminder email or make a phone call to discuss the outstanding payment and any reasons for the delay. Maintaining open communication with clients regarding payments can help resolve issues quickly and ensure that you receive timely compensation for your services.

Consider Using Invoicing Software

For contractors managing multiple clients and projects, using specialized invoicing software can streamline the invoicing process and help track payments more efficiently. Invoicing software often offers features such as customizable templates, automated payment reminders, and financial reporting tools. By leveraging technology, contractors can save time and reduce the risk of errors in their invoicing practices.

Tips for Successful Invoicing

To ensure successful invoicing as an independent contractor, consider the following tips:

Set Clear Payment Terms

Clearly communicate your payment terms to clients upfront to avoid any misunderstandings regarding payment expectations. Specify the payment due date, accepted payment methods, and any late fees or penalties for overdue payments. By setting clear terms from the start, you establish a transparent payment process that benefits both you and your clients.

Follow Up on Overdue Invoices

Don’t hesitate to follow up on overdue invoices with clients to inquire about the payment status. Sending polite reminders or making a phone call to discuss the outstanding balance can prompt clients to prioritize the payment. Maintaining regular communication regarding payments shows your commitment to financial responsibility and helps ensure timely compensation for your work.

Maintain Organized Records

Keep detailed records of all your invoices, payments received, and outstanding balances to stay on top of your financial management. Use accounting software or create a filing system to track invoices by client, project, or date. Having organized records not only helps you manage your income but also simplifies tax preparation and financial planning for your business.

Review Invoices for Accuracy

Before sending out an invoice to a client, double-check the document for accuracy and completeness. Ensure that all details, including the description of services, costs, and payment terms, are correct. By reviewing your invoices carefully, you can avoid errors that could lead to payment delays or disputes with clients.

Provide Detailed Descriptions

When describing the services rendered in your invoice, be as detailed as possible to justify the cost to the client. Break down the tasks performed, hours worked, and any materials or expenses incurred during the project. By providing a thorough description, you demonstrate the value of your services and give clients a clear understanding of what they are paying for.

Offer Multiple Payment Options

Consider offering clients multiple payment options to make it easier for them to settle their invoices. Accepting various payment methods, such as bank transfers, credit cards, or online payment platforms, can accommodate different client preferences and streamline the payment process. By providing convenient payment options, you make it more convenient for clients to pay you promptly.

Set Up Automated Invoicing

Automating your invoicing process can save time and ensure that invoices are sent out promptly. Consider using invoicing software that allows you to schedule recurring invoices, set up payment reminders, and track invoice status. By automating repetitive tasks, you can focus on client work and business growth while maintaining a consistent invoicing schedule.

Establish a Payment Schedule

To encourage timely payments from clients, consider establishing a clear payment schedule that specifies when invoices are due and outlines the preferred method of payment. Communicate this schedule to clients at the beginning of a project to set expectations regarding payment deadlines. By outlining a payment schedule upfront, you reduce the likelihood of payment delays and help maintain a steady cash flow for your business.

Send Professional Invoices

Presenting clients with professional and well-designed invoices reflects positively on your business and enhances your credibility as a contractor. Use a consistent invoice template that incorporates your branding elements, including your logo and color scheme. By sending polished and professional invoices, you reinforce your commitment to quality and professionalism in your work.

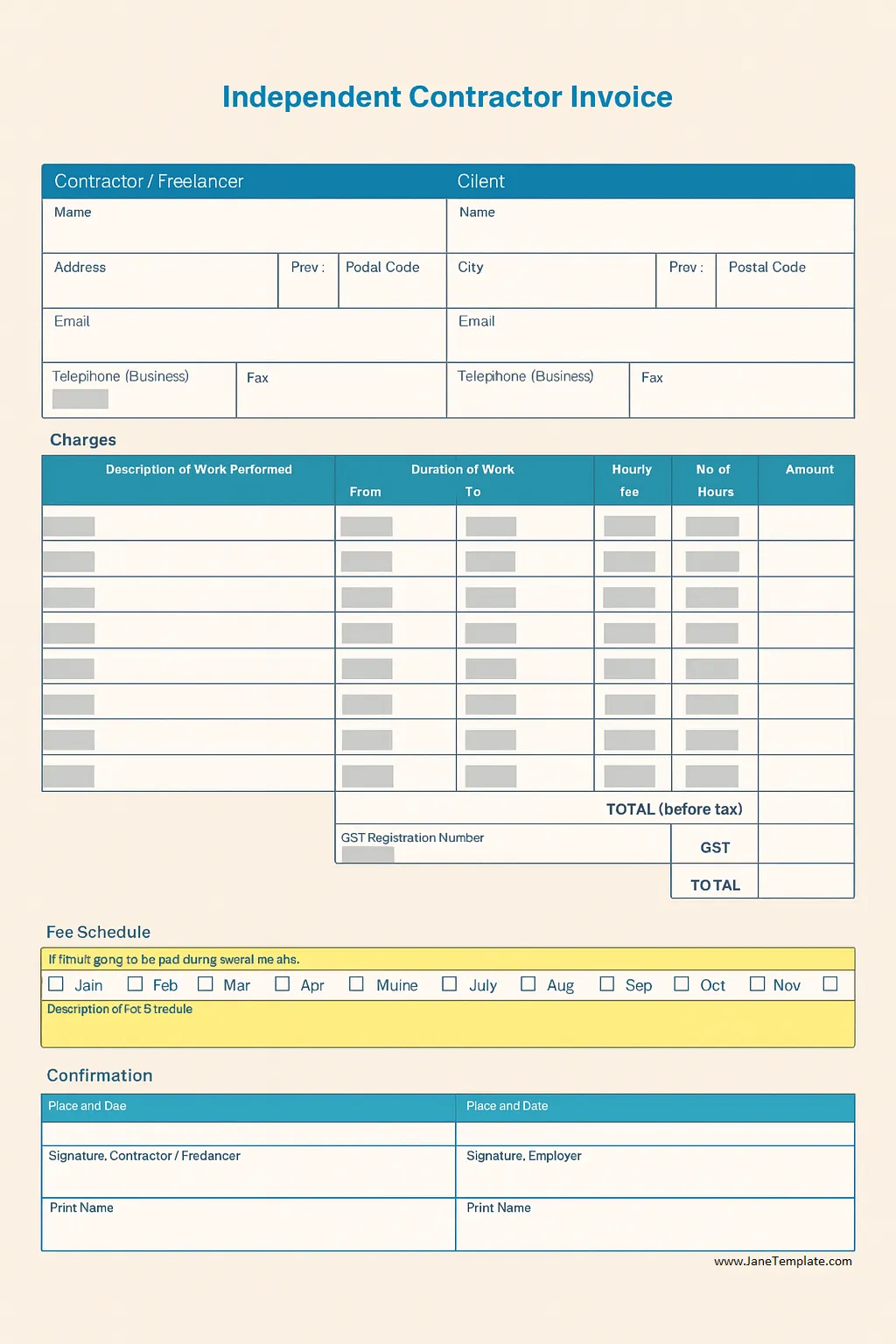

Independent Contractor Invoice Template

An Independent Contractor Invoice helps you bill clients clearly and professionally by outlining services provided, hours worked, rates, and payment details in an organized format. It reduces confusion, supports timely payments, and keeps your financial records accurate and easy to manage. With a clean, structured layout, invoicing becomes faster, smoother, and more reliable.

Download the Independent Contractor Invoice Template today to create polished, accurate invoices with confidence.

Independent Contractor Invoice Template – WORD