Rent-to-own agreements offer a unique opportunity for individuals who may not be ready to purchase a property immediately, providing a flexible pathway to homeownership.

This arrangement enables renters to live in a property with the option to purchase it in the future, providing them with time to save for a down payment and improve their credit score. On the other hand, sellers benefit from consistent rental income and a committed buyer, even in a fluctuating housing market.

What Is a Rent-to-Own Agreement?

A rent-to-own agreement, also known as a lease-option or lease-to-own agreement, is a contract between a tenant and a property owner that allows the tenant to rent the property for a specified period with the option to purchase it at a later date.

This type of agreement typically involves an upfront option fee and a portion of the monthly rent being credited towards the purchase price of the home. It offers a unique opportunity for individuals who may not qualify for a traditional mortgage to work towards homeownership.

Advantages of a Rent-to-Own

- Flexibility: Rent-to-own agreements offer flexibility for tenants who may not be ready to commit to a long-term mortgage. This flexibility allows tenants to test out the property and the neighborhood before making a long-term commitment.

- Ability to Build Equity: Tenants have the opportunity to build equity in the property while renting, helping them save for a down payment. This can be especially beneficial for individuals who are working on improving their credit score.

- Lock-in Purchase Price: Rent-to-own agreements allow tenants to lock in the purchase price of the property at the beginning of the lease term, protecting them from market fluctuations. This can be advantageous in a rising real estate market.

Disadvantages of a Rent-to-Own

- Higher Monthly Payments: Rent-to-own agreements may come with higher monthly payments compared to traditional rental agreements, as a portion of the rent is being credited towards the purchase price of the home.

- Non-Refundable Option Fee: The upfront option fee paid by the tenant is typically non-refundable, meaning that if the tenant decides not to purchase the property at the end of the lease term, they may lose this fee.

- Risk of Property Depreciation: If the property depreciates during the rental period, the tenant may end up paying more for the property than it is worth at the time of purchase.

How Does Rent-to-Own Work?

In a rent-to-own arrangement, the tenant agrees to rent the property for a set period, usually one to three years, with the option to buy it at the end of the lease term.

During the rental period, the tenant pays a monthly rent along with an additional amount that is credited towards the purchase price of the property. This allows the tenant to gradually build equity in the home while also having the flexibility to walk away from the deal if they choose not to purchase the property at the end of the lease term.

Who Should Consider Rent-to-Own?

Rent-to-own agreements are ideal for individuals who have a steady income but may not have a large down payment or strong credit history required for a traditional mortgage. It is also a good option for those who are uncertain about their long-term housing needs or are looking to test out a neighborhood before committing to buying a home in the area.

Considerations When Entering a Rent-to-Own Agreement

Entering into a rent-to-own agreement is a significant decision that requires careful consideration from both the tenant and the landlord. Before signing the contract, it’s essential to understand the terms and conditions of the agreement to ensure that all parties are on the same page. Here are some key considerations to keep in mind:

Contract Terms

- Lease Term: The length of the lease term is an important factor to consider. It should provide tenants with enough time to save for a down payment and improve their credit score while also giving sellers a sense of security in knowing that they have a committed buyer.

- Purchase Price: The agreed-upon purchase price of the property should be fair and reflective of the current market value. Tenants should research comparable properties in the area to ensure they are getting a good deal.

- Rent Credits: Understanding how much of the monthly rent is being credited towards the purchase price of the home is crucial. This will determine how much equity tenants are building over time.

Property Condition

Before entering into a rent-to-own agreement, tenants should thoroughly inspect the property to ensure it meets their expectations. It’s essential to look for any signs of damage or needed repairs and address them with the landlord before signing the contract. Sellers should also disclose any known issues with the property to avoid potential disputes down the line.

Financial Stability

Both tenants and landlords should assess their financial stability before entering into a rent-to-own agreement. Tenants should have a steady income and a plan to save for a down payment and improve their credit score during the rental period. Landlords should be able to cover the costs of owning the property, such as mortgage payments, property taxes, and maintenance expenses.

Exit Strategy

Both parties need to have a clear exit strategy in place in case the tenant decides not to purchase the property at the end of the lease term. Tenants should be aware of any penalties or fees associated with walking away from the deal, such as forfeiting the option fee or rent credits. Landlords should also have a plan for what to do if the tenant chooses not to buy the property, such as relisting it on the market or finding a new tenant.

Legal Considerations

Seeking legal guidance before entering into a rent-to-own agreement is highly recommended. A real estate attorney can review the contract terms, ensure that all legal requirements are met, and guide on any potential risks or pitfalls. Having legal representation can help protect both tenants and landlords and ensure that the agreement is fair and enforceable.

Maintaining Communication

Open and honest communication between tenants and landlords is crucial throughout the rent-to-own agreement. Both parties should regularly check in with each other to discuss any issues or concerns that may arise. This communication can help prevent misunderstandings, resolve disputes, and ensure that the agreement progresses smoothly towards a successful purchase transaction.

Educating Yourself

Before entering into a rent-to-own agreement, both tenants and landlords need to educate themselves on the process and understand their rights and responsibilities. This may involve researching local real estate laws, seeking advice from real estate professionals, and familiarizing yourself with the terms commonly used in rent-to-own agreements. The more informed you are, the better equipped you will be to navigate the agreement successfully.

Seeking Professional Advice

If you are considering entering into a rent-to-own agreement, it’s a good idea to seek advice from professionals in the real estate industry. Real estate agents, mortgage brokers, and attorneys can provide valuable insight and guidance to help you make informed decisions. These professionals can help you understand the terms of the agreement, negotiate favorable terms, and ensure that the transaction is legally sound.

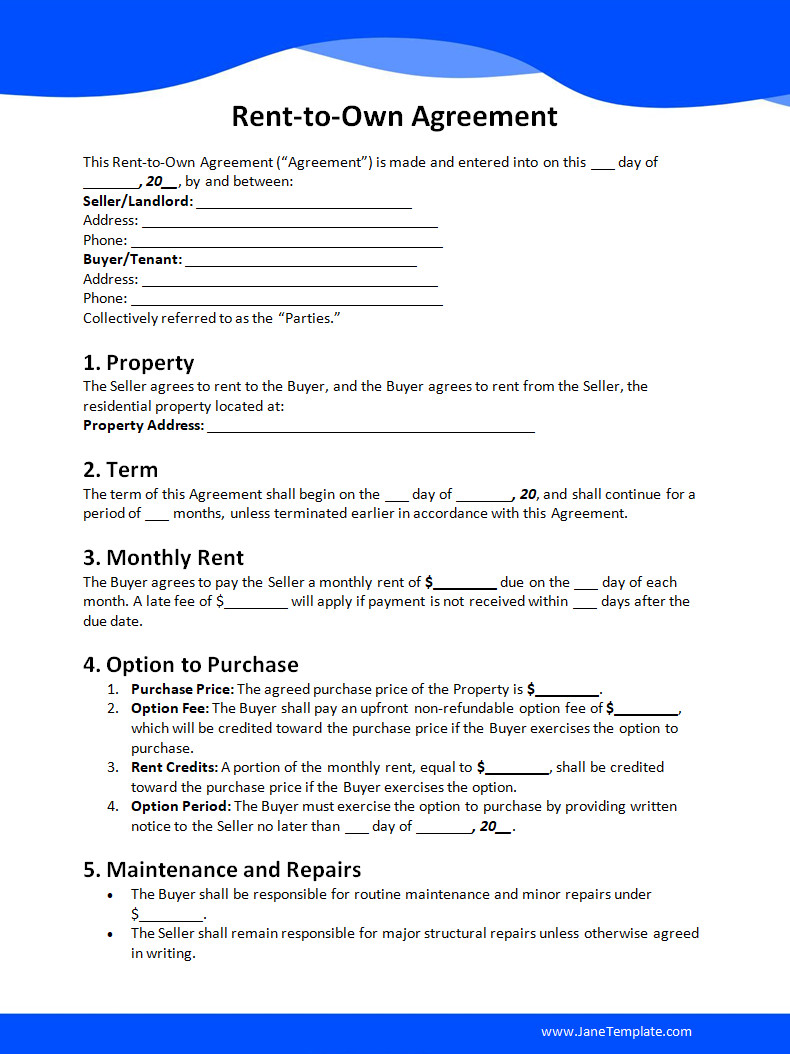

Rent-to-own Agreement Template

A rent-to-own agreement is a helpful resource for outlining the terms between a landlord and tenant when renting with the option to buy. It provides clarity on rental payments, purchase conditions, and responsibilities, protecting both parties throughout the process.

To make your arrangement clear and professional, use our free rent-to-own agreement template and set up your deal with confidence!

Rent-to-own Agreement Template – Word